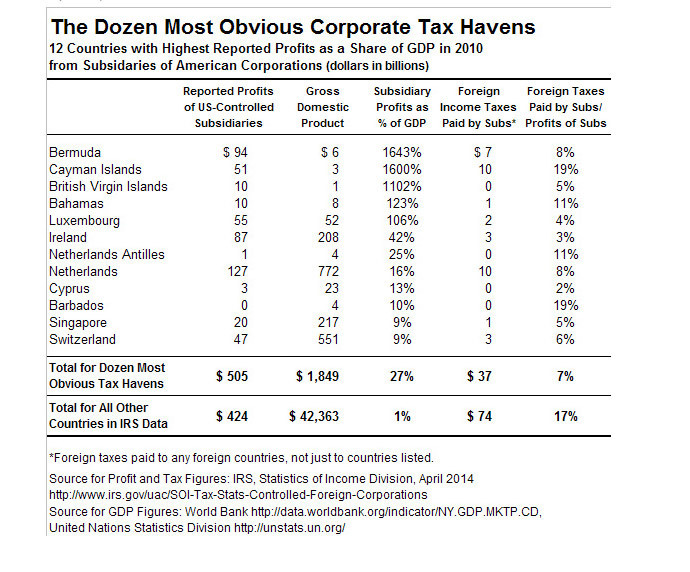

Top 12 tax havens for US companies

Published 30 May, 2014 11:32 | Updated 30 May, 2014 12:04

US corporations are making record profits in tax havens like Bermuda, the Cayman Islands, and the British Virgin Islands (BVI). Some of the profits exceed the GDP of the host country, with Bermuda’s offshore profits 1643% of total economic output.

As a share of Gross Domestic Product (GDP), profits from subsidiary US companies operating in the Netherlands are more than 100 percent of the country’s annual economic output, according to a new study by Citizens for Tax Justice, published Tuesday.

In Bermuda, US companies reported $94 billion in profit, but the

island’s GDP is only $6 billion.

The report draws on data collected by the US International

Revenue Service from subsidiaries reporting profits outside of

the US in 2010.

“Clearly, American corporations are using various tax gimmicks to shift profits actually earned in the US and other countries where they actually do business into their subsidiaries in these tiny countries,” the report says.

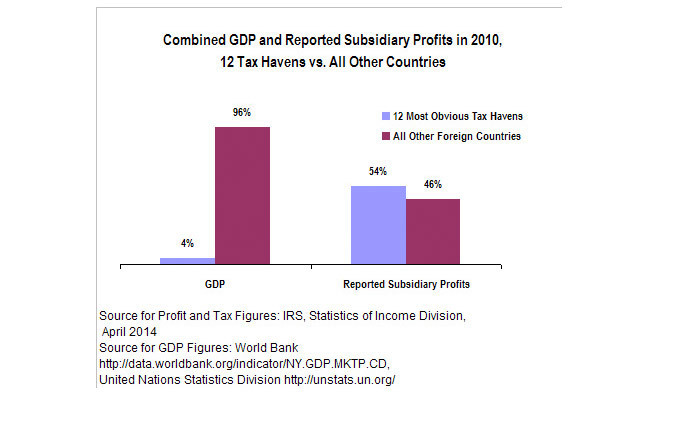

US companies filed the largest profits in the Netherlands, Bermuda, Ireland, Luxembourg, the Cayman Islands, Switzerland, Singapore, the Bahamas, the British Virgin Islands, Cyprus, the Netherlands Antilles, and Barbados. But none of these finances are factored into the GDP of the host countries.

When filing US income taxes, a foreign corporation is defined if its US shareholders control more than 50 percent of the outstanding voting stock.

Offshore wealth –money that is kept abroad for tax purposes- is a popular tactic for American companies to avoid paying high taxes in the US. Google, Apple, and other hi-tech companies have all been accused of “sheltering” money abroad and not contributing enough to the American tax system, which is their main market.

Many US companies use a loophole called “repatriation” in order to delay paying the US government taxes. Under US tax law, companies with offshore subsidiaries can wait until their company is “repatriated”, or returned to the US, until they pay taxes. This tool encourages US companies to report profits outside of the US, where they are safe from high taxes.

Other countries can offer very attractive corporate tax rates compared to the required 40 percent in America. Bermuda, the Cayman Islands, and the Bahamas for example, have a rate of 0 percent.

Ireland has a corporate tax rate of 12.5 percent, Switzerland 17.92 percent, and Luxembourg a local rate of 29.22 percent, according to data from KMPG Global.

The only country where companies pay more taxes than in America is in the United Arab Emirates, which has a 55 percent corporate tax rate.

Countries, or tax havens, can provide opportunities for investors by lowering their corporate tax rates as well as income tax rates.

Low income tax rates can make investment more competitive and business climate more attractive for some investors looking for loopholes. An estimate by Boston Consulting Group pegs offshore wealth at $8.5 trillion. Other independent estimates peg it as high as $20 trillion.

With the G20 and OECD countries focused on curbing tax evasion and avoidance, several Caribbean countries – Bermuda, Barbados and Cayman Islands – would be subject to a tightening tax noose. These countries could face a deceleration in economic activity if international tax structures are to be dismantled.