The votes are in: How 'yes' vote will change Scotland's economy

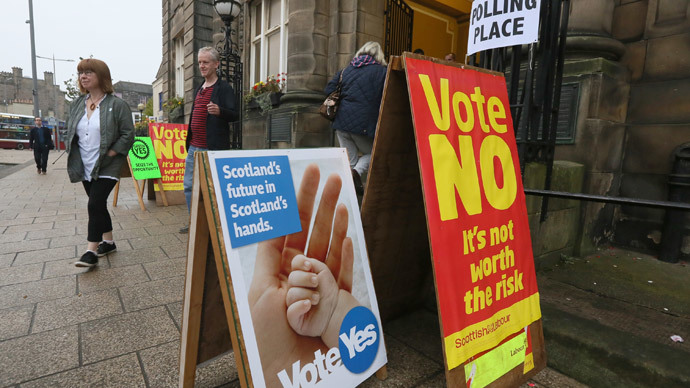

The votes are in and being tallied. Will Scotland become the new Scandinavia or a failed state if it achieves independence? Here is a look at what happens to Scotland’s economy if it votes 'Yes' to become an independent country.

If the referendum is successful, Scotland will become an independent country on March 24 2016, which will be the 309th anniversary of its economic and political union with England.

Follow RT's Scottish Independence Referendum LIVE UPDATES

Scotland’s $250 billion economy will be forced to break its many financial ties with Britain’s $2.5 trillion economy, which the Nationalists have campaigned as economic freedom, and the ‘Better Together’ side say spells economic ruin for the Scots.

A survey by a UK-based financial service company that polled 200 fund managers in Britain said Scotland faces“decade of economic decline” if it votes 'yes'. It found that 63 percent of those polled believe Scotland’s economy will be weaker for the next 10 years if it breaks away from Britain.

Britain’s major political parties have promised Scots more autonomy over tax and welfare spending if they choose to stay in the United Kingdom.

The business community, both in London and in Scotland, has mostly thrown their support into a “No” vote, warning that Scotland’s ties to London are too integrated to risk harming. But more than 200 Scots business leaders have also expressed their support for independence, arguing than London-centricity is unsustainable.

Here's a brief outlook of what independence means for the Scottish economy:

- Scots would begin to set out their own fiscal policy, separate from the UK

- It will need to decide on the future of its currency. The options available include keeping the pound – either with or without permission,- adopting the euro or adopting a new currency

- It stands to lose £65.2 billion in UK public spending

- The Scottish government may assume a 90 percent share of UK oil revenues, which in 2013 were £6.1 billion, but are expected to fall to £4.7 billion in 2014

- An independent Scotland could claim part of the UK’s £7.8 billion gold reserves

- Like Norway, an independent Scotland would set up an oil fund to manage North Sea-generated oil revenues. A major challenge will be the variability and predicted fall in oil prices

- Gas, electricity, postal service and other state services would shift to Scottish authority

- Banks like Royal Bank of Scotland and Lloyds Banking Group may switch headquarters to London