World wealth has reached a record $263 trillion but is concentrated in fewer hands. The richest 1 percent have accumulated more wealth, and own almost 50 percent of it, which could trigger recession, according to a new report by Credit Suisse.

The Credit Suisse Global Wealth Report, released Tuesday warns that the “abnormally high wealth income ratios” may spark a recession, as high disparity leads to economic friction.

Global wealth has grown to a record $263 trillion in mid-2014, $20.1 trillion more, and an 8.3 percent increase, over mid-2013. Household wealth has more than doubled since 2000, when the same report calculated it at $117 trillion.

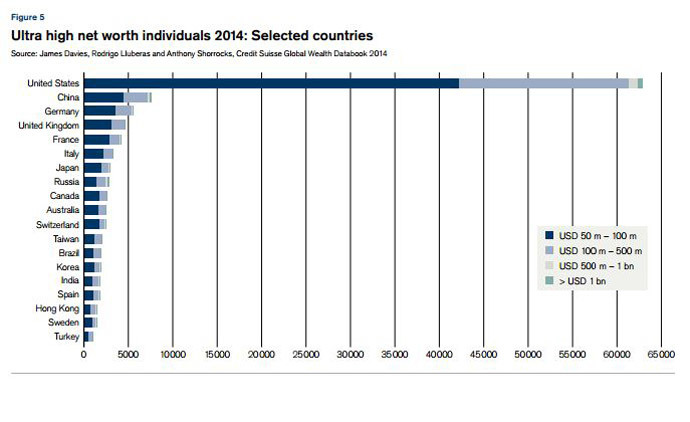

Leading the money trail is the United States, dubbed 'Land of Fortunes' by the report, which again boasts the highest average wealth. It is home to 34.7 percent ($91 trillion) of global wealth. Europe’s portion comes in a close second with 32.4 percent, followed by India and China’s 23.7 percent share, and then the 18.9 percent concentrated in the Asia-Pacific region.

North America has the highest average wealth and is also the world’s leader in GDP, which the report estimates grew by $12.9 billion in 2013.

Wealth in the US and Europe was driven by a rather spectacular year on the stock exchanges. Since the financial crisis of 2008, the US has added $31.5 trillion in household wealth. In the last year alone the stock market increased in value by 22.6 percent.

Germany, Canada, and France all experienced huge spurts in

capital markets, gaining more than 30 percent.

Much of the world’s “new money” is coming from China and

developing nations. Between 2000 and 2014, emerging markets

accounted for 11.4 percent of wealth.

“As we noted last year, Asia and particularly China will account for the largest portion of newly created wealth among the emerging markets,” the report says.

Other emerging players on the international scene, according to Credit Suisse, are Russia, Brazil, India, Indonesia, South Africa, and Turkey.

The conclusion of the report offers predictions for 2019, where the authors suggest global wealth will grow by 40 percent and reach $369 trillion, but emerging markets will account for 26 percent, more than double what they do now.

The number of millionaires worldwide is projected to blossom from 35 million today to 53 million in 2019.