Russian Central Bank cut currency interventions by up to 97% in November

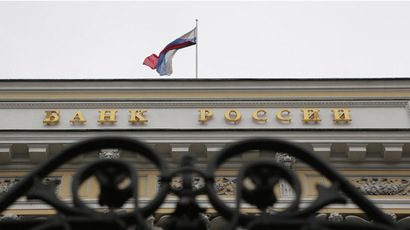

The Central Bank of Russia (CBR) has dramatically cut the amount of dollars and euro it has spent in the currency market in November after it decided to let the ruble free float, and intervene only in critical situations.

The Bank of Russia spent $773.9 million and €221.6 million last month on currency interventions, according to data released on its website Tuesday. Dollar interventions were down by 97 percent from the $27.2 billion previously spent, and euro interventions were down 13.8 percent from €1.6 billion.

The sharp decline highlights the bank’s landmark decision to end almost two decades of currency controls. On November 10, the Central Bank let the ruble float freely, lifting the dual-currency band and ending regular foreign exchange interventions. Instead, the Bank said it would intervene unexpectedly, “at whatever moment and amount was needed to decrease speculative demand,” the bank’s chairwoman, Elvira Nabiullina, said at the time.

READ MORE: Russia ends dollar/euro currency peg, moves to free float

The ruble’s recovery was short-lived after the announcement. The currency has since started losing ground rapidly as oil prices declined sharply.

READ MORE: Cheaper oil takes Russian ruble to new lows; officials say no reason to worry

Ruble exchange rates have reached new lows in Tuesday trading after the World Bank (WB) and the Russian Ministry of Economic Development cut their 2015 growth forecast for Russia.

The ruble fell to new all -time lows around 54 to the dollar and 67 to the euro, data from the Moscow Exchange shows.

The World Bank cut its projections to zero growth in 2015 from 0.3 percent previously. The bank said Russia may not be able to substitute for declining imports next year, which are shrinking on the back of western sanctions and a more expensive dollar.

The Ministry of Economic Development made a more dramatic forecast, saying GDP is expected to fall by 0.8 percent, Deputy Minister Alexei Vedev told TASS.