World record debt of $199trn could drag economies into another crisis - study

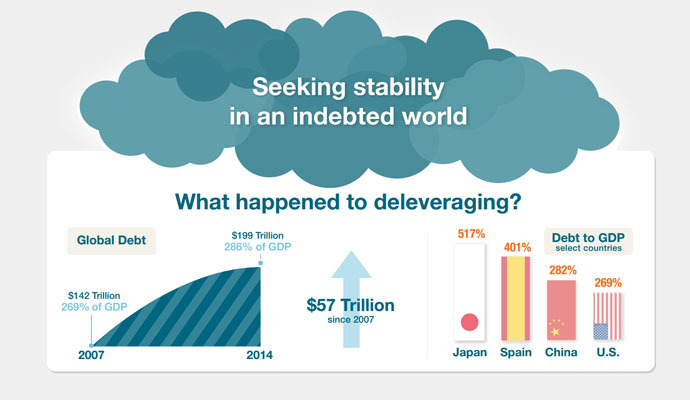

Global debt has soared by $57 trillion since the outbreak of the financial crisis in 2007, with the debt to GDP ratio jumping to above 500 percent in Japan. This raises questions about financial stability and poses a threat of another crisis.

“After the 2008 financial crisis and the longest and deepest global recession since World War II, it was widely expected that the world’s economies would deleverage. It has not happened. Instead, debt continues to grow in nearly all countries, in both absolute terms and relative to GDP. This creates fresh risks in some countries and limits growth prospects in many,” according to new research carried out by consultants McKinsey in 47 countries.

The amount of world debt reached $199 trillion at the end of 2014, with the growth rate exceeding the pace of global economic expansion and the debt to GDP ratio increased from 269 to 286 percent.

“Higher levels of debt pose questions about financial stability and whether some countries face the risk of a crisis.”

“We conclude that, absent additional steps and new approaches, business leaders should expect that debt will be a drag on GDP growth and continue to create volatility and fragility in financial markets,”the McKinsey report says.

Deleveraging remains limited to a handful of sectors in some countries. The only countries that managed to cut their debt were Argentina, Romania, Egypt, Saudi Arabia and Israel.

Geographically, Ireland was the country where the debt to GDP ratio saw a record increase – of 172 percent. The ratio in Japan added 64 percent and remains the world’s highest at 500 percent. In Russia, the debt to GDP ratio saw a moderate growth by 19 percent, remaining relatively low at 65 percent.

China is one of the key concerns as debt there has skyrocketed almost quadrupling, from $7.4 trillion in 2007 to $28.2 trillion in mid-2014. The debt-to-GDP ratio reached 282 percent comparing to 269 percent of the US. Although total Chinese debt is still manageable, experts are concerned with worrisome levels of debt in the property sector and the rapid expansion of shadow banking.

“China’s total debt, as a percentage of GDP, now exceeds that of the United States.”

Falling debt in the financial sector and a retreat in many of the riskiest forms of shadow banking are the only bright spots in the report. But the overall global debt burden “has reached new levels despite the pain of the financial crisis,” the report said.

Households across the world have also significantly increased their debt, with their debt relative to income having decreased in only five advanced economies - the United States, Ireland, the United Kingdom, Spain, and Germany. In such developed countries as Australia, Canada, Denmark, Sweden and the Netherlands, as well as Malaysia, South Korea and Thailand, the debt exceeds the pre-crisis level.

To avoid another crisis, the governments might take recourse to new ways of reducing the national debt such as larger sales of assets, non-recurrent wealth taxes and more effective programs of debt restructuring, the report said.

“Policy makers will need to consider a full range of responses to reduce debt as well as innovations to make debt less risky and make the impact of a future crisis less catastrophic.”