Oil surges 6% after Saudi launches military airstrikes in Yemen

Brent and WTI added more than 4 percent after Saudi Arabia and its allies launched a military operation in Yemen against Shiite Houthi rebels. Saudi Arabia is the biggest oil supplier in the region, and southern Yemen is home to many LNG hubs.

WTI shot up more than 6.43 percent to $52.38 per barrel, and Brent climbed to $59.71, a 5.72 percent increase at 11:00 am Moscow time. Saudi Arabia and nine allied countries began airstrikes at 11 pm GMT, deploying a total of 70 fighter jets.

READ MORE: Saudi Arabia bombs Yemen, launches coalition op against Houthi rebels

The Saudi ambassador to the US said the airstrikes were launched to “defend the legitimate government” of President Abdrabbuh Mansour Hadi, who fled Aden by boat on Wednesday after a massive attack by Iranian-backed Shia rebels. Hadi relocated to Aden from Sanaa after the capital city was overran by the Shia Houthi rebels in September.

An all-out conflict in the Middle East with the US backing one side and Iran the other, has oil traders very bullish on crude prices.

What's going on with oil pic.twitter.com/cecJRgpyUm

— zerohedge (@zerohedge) March 26, 2015

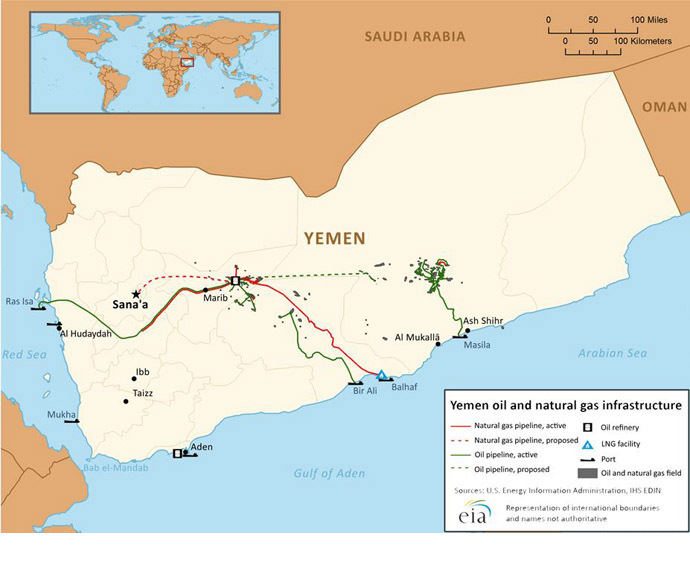

Although Yemen isn’t a major hydrocarbon producer, the Gulf state has an extensive shoreline that hosts some of the world’s most strategic shipping routes.

More than 3.4 million barrels of oil per day, including significant amounts of Saudi oil, flow through the Strait of Bab el-Mandab, which links the Red Sea with the Gulf of Aden and the Arabian Sea, according to the US Energy Information Administration, which has identified the waterway as a “transit chokepoint.”

Though an energy shortage has temporarily boosted oil prices, crude production overall is outstripping demand, especially in countries outside of the Middle East, such as the US and Russia.