China devalues yuan 2 days running, ripple effect sends suppliers reeling

The People's Bank of China lowered the official exchange rate of the yuan against the dollar by a further 1.6 percent, bringing the exchange rate to 6.33 per dollar. This immediately resulted in a drop in Chinese stocks.

Asian markets finished sharply lower on Wednesday with Hong Kong topping the region. The Hang Seng was down 2.57 percent, Japan's Nikkei slumped 1.58 percent and Shanghai Composite dropped 1.06 percent.

On Monday, when Beijing staged the biggest devaluation of the yuan in a single day since January 1994, the authorities said it was only a one-time adjustment.

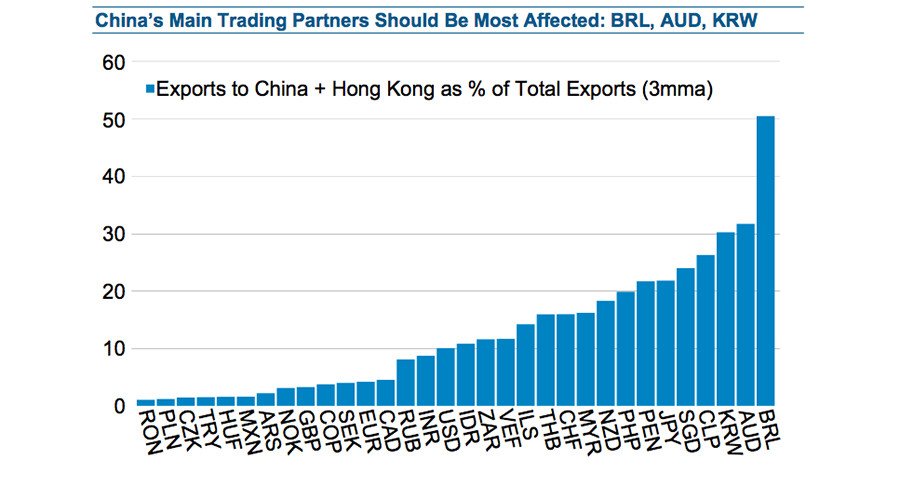

A cheaper yuan means economies that produce raw materials for the world’s biggest commodity consumer, including Australia, Brazil, Chile and South Korea, will suffer.

“Our commodity team has estimated that a 1 percent move in the [yuan] is associated with a 0.5-0.6 percent decline in USD commodity prices," said Bank of America in a note following the devaluation.

The falling demand from China has already made impact on them, but the two-day devaluation is a double-blow.

China is the world's largest consumer of most commodities http://t.co/xiiOI97wKCpic.twitter.com/Xyzp7fwGK4

— Sam Ro (@bySamRo) August 11, 2015The drastic move is seen as Beijing’s attempt to reanimate its exports, which had dropped 8.3 percent in July, compared to a year before. The weaker yuan gives the exporters bigger revenues from their foreign trading.

China has now let the markets determine its currency rate, making a “shift to a more market-determined exchange rate.”

The world’s second-biggest economy has recently been struggling. Poor performance in real sector has made the 7 percent growth target in 2015 much less feasible, as manufacturing and trade are tumbling.

READ MORE: New restrictions from Beijing boost Chinese stocks

Chinese markets are currently on a roller-coaster. A daily collapse is usually led by multibillion-dollar injections and restrictions from the China Securities Regulatory Commission (CSRC), in charge of stabilizing the market, which has lost some $4 trillion since its peak in mid-June. The data last week showed that the commission had injected more than $32 billion to slow down the collapse.