Zimbabwe launches new currency to ease cash crunch

The Reserve Bank of Zimbabwe has introduced a national currency for the first time since 2009 in an attempt to tackle a sharp shortfall of the US dollar, the country’s primary medium of trade.

The new currency, called bond notes, is pegged at par with the US dollar and is backed by a $200 million bond facility with Afreximbank, according to the regulator.

An initial amount worth $10 million is going into general circulation in two and five dollar denominations.

The circulation of the dollar will not be suspended.

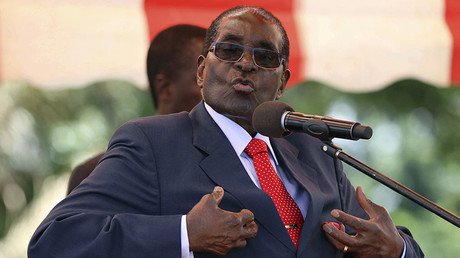

The bond notes have fueled fears of economic chaos with people’s savings being wiped out. Some analysts call the introduction of the new currency the Zimbabwean president’s “last gamble.”

The bond notes aim to halt the outflow of US dollars from the country as well as to ease a cash shortage.

The country started using US dollar as its primary currency seven years ago following the collapse the Zimbabwean dollar with hyperinflation of 500 billion percent.

Some vendors are accepting the new money, though say they will stop if the notes begin to lose value.

The introduction of the currency might cause shortages of commodities and price hikes, according to Harare-based economic consultant John Robertson.

READ MORE: Foreign firms in Zimbabwe have till April 1 to sell shares to blacks or close

“Anyone who needs foreign currency for imports will have to go to the black market. Inevitably the bond notes will lose their value. It is back to the Zimbabwe dollar scenario,” he said as quoted by AP.