Trump presidency may mean 30-yr bond rally about to end

The Bloomberg Barclays Global Aggregate Total Return Index slid four percent last month, losing $1.7 trillion, the biggest fall since its launch in 1990. Some investors are dumping low-yield bonds and turning to stocks.

The main reason for that was Donald Trump winning the US presidential election, as speculators expect him to cut taxes and invest $1 trillion in infrastructure projects.

According to Bloomberg, after Trump’s victory, investors dumped $10.7 billion of American bonds, while domestic stocks rose to record highs. This is the biggest flee from the American bond market since the 'taper tantrum' in 2013.

Globally, equity markets’ capitalization rose $635 billion.

However, UK investors are not that bearish about bonds, raising bond allocations near 30 percent of balanced global portfolios in November. According to Reuters, the share of American bonds in their debt portfolios was at a three-month high.

"The United States is likely to err on the side of caution in terms of increasing rates," Justin Onuekwusi, a fund manager at Legal & General Investment Management told the agency.

The investor said Europe is not that pessimistic about bonds.

"We still ultimately think rates are likely to remain lower for longer. We have the ECB, BoJ, and the BoE all buying bonds, central bank balance sheets are at unprecedented highs as a percentage of GDP since the financial crisis," he added.

"It is prudent to remember (government bonds) have delivered excellent returns over the last one, three and five-year periods through conditions similar to today – a surprise to many. It is more than possible that they will continue to surprise," said Mouhammed Choukeir, chief investment officer of Kleinwort Hambros.

In August, RIT Capital Partners Chairman Jacob Rothschild said low interest rates, negative yields on government debt and quantitative easing are part of the biggest economic experiment in world history, and the consequences are yet to be found out.

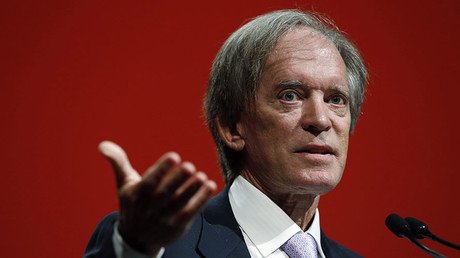

Janus Capital has noted that global yields are the lowest in 500 years, and the total amount of such bonds is $10 trillion. The leading investor in the fund Bill Gross called it a “supernova that will explode one day.”