Iran’s sinking rial despite record oil output

The Iranian rial has plummeted to a record low against the US dollar, continuing a six-month decline that has seen the currency fall nearly 19 percent, despite the lifting of sanctions.

This week the currency has dropped to 41,600 rials to the dollar, its lowest point ever, further extending the gap with the official government rate fixed at 32,300.

The slide has accelerated since the victory of Donald Trump in the US election. He has pledged to renegotiate the Iranian nuclear deal with world powers. At the same time, the country's economy has not yet seen the benefits of sanctions being lifted.

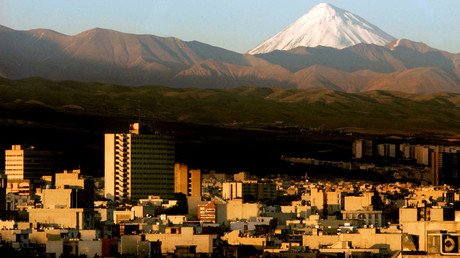

“Surely this negatively impacts people's lives. Lots of foreign goods are imported into our country and many of the things people need come from abroad. It also has a very negative psychological effect on the people,” said a Tehran resident as quoted by CNBC.

The rial has seen a fall from around 9,200 to 41,600 to the dollar over the last decade, a depreciation of nearly 450 percent. Much of the collapse came in 2012 when the US banned the world's banks from taking part in deals with Iran, and the European Union imposed its oil embargo.

According to the 2015 nuclear accord, international sanctions against the Islamic Republic were lifted in return for the country limiting its enrichment of uranium. Since then, Iran has sharply increased crude output aiming to recoup market share lost over the years.

#Iran's Rial hits record low as Trump worries deter fund inflows, continuing 6mth decline despite lifting sanctions. https://t.co/y5AfZv69hQpic.twitter.com/bNr3MFr1Up

— Holger Zschaepitz (@Schuldensuehner) December 26, 2016

Removing some of the restrictions hasn’t given a free hand to international banks to work with Iran’s currency, with payments being delayed, according to the authorities.

READ MORE: Iran says US sanctions violate nuclear deal, demands meeting of world powers

That means harder times for average Iranians. “This is tragic to me. I have lost 20 percent of my purchasing power with this exchange rate because all prices are going up harshly,” said Ahmad Heidari, a 64-year-old retiree, as quoted by CNBC.

Tehran has manipulated the currency market to cover budget deficits, using the difference between the lower government exchange rate and the higher market exchange rate to gain rials from oil sales.

arre baapre, 1 dollar chi kimmat 32 hazaar? #Iran#rialpic.twitter.com/yQj7FMos2r

— Shrinivas (@ShriBhivaskar) December 12, 2016

The measure known as arbitrage might spring to action, according to Hassan Salimi, the head of the Investment Group of Iran's Chamber of Commerce.

“The government believed that it could sell a barrel of oil from $65 to $70 in 2017, but now it is certain that the price of oil will stay around $50. Therefore, to make up for the deficit, it has increased the exchange rate,” Salimi said.