$25 trillion investment needed to meet future oil demand

The world needs to invest $25 trillion in new oil-producing capacity over the next 25 years to meet growing demand, Saudi Aramco’s chief executive Amin Nasser said at the World Economic Forum in Davos on Tuesday.

According to the CEO of Saudi Arabia’s giant state-held oil company, global demand for oil and gas will still grow in the coming decades, so if capital investment drops, it could create “spikes” in prices and hurt the global economy, CNBC reports. Demand is still healthy and oil “will be with us for decades”, CNBC quoted Nasser as telling a Wall Street Journal panel at the Davos forum.

The global oil and gas industry needs to expand and requires more investment, Nasser said.

Read more on Oilprice.com: 5 Energy Stocks To Watch In 2017

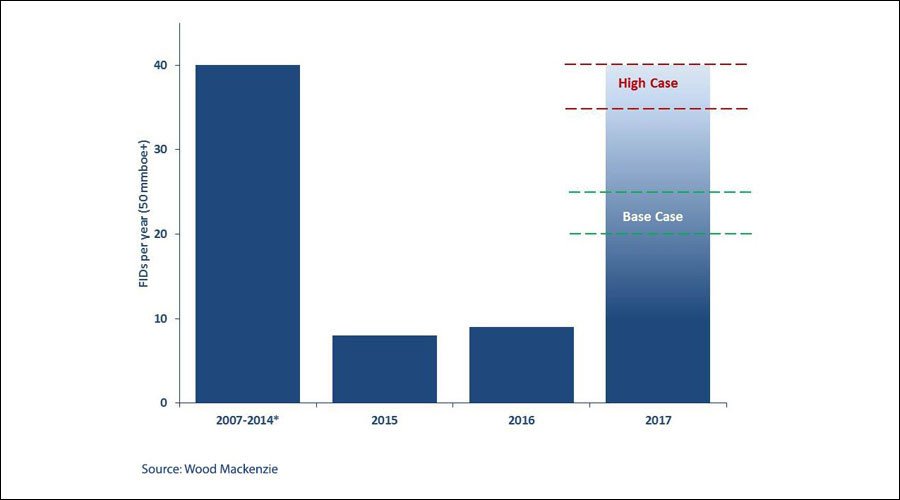

After two years of significantly lowered capital investment by the industry, a recent report by Wood Mackenzie suggests that “the global investment cycle will show the first signs of growth in 2017, bringing the crushing two-year investment slump to a close”.

WoodMac sees E&P global spend rise with about 3 percent in 2017 to around $450 billion. According to WoodMac’s Malcolm Dickson, ‘’companies will get more bang for their buck,” as internal rates of return jump from 9 to 16 percent, comparing 2014 to 2017.

The chart below from WoodMac shows that the amount of final investment decisions (FID’s) are expected to double in 2017, compared to 2016.

The Impact of Renewables

At the WEF, Saudi Aramco’s chief executive noted that renewables would gain some market share in the long run, but renewable energy would not dominate.

“It will take decades for them [renewables] to replace petroleum resources. So what we are doing in Saudi Aramco we are building our capacity in the oil,” according to the manager.

Saudi Arabia currently has oil capacity of 12.5 million bpd, which it continues to build upon, Nasser said.

The Kingdom also plans to double its gas capacity over the next decade, which would enable it to ship more crude oil onto the market, Saudi Aramco’s manager added.

Just yesterday, Saudi Arabia’s Energy Minister Khalid Al-Falih said that his country would begin soliciting bids for a “massive” renewable energy push, with spending reaching as high as $50 billion. The move is intended to source at least 10 GW of electricity from solar and wind by 2023, a rapid escalation of renewable energy installations for the Kingdom in order to conserve oil for exports.

This article was originally published on Oilprice.com