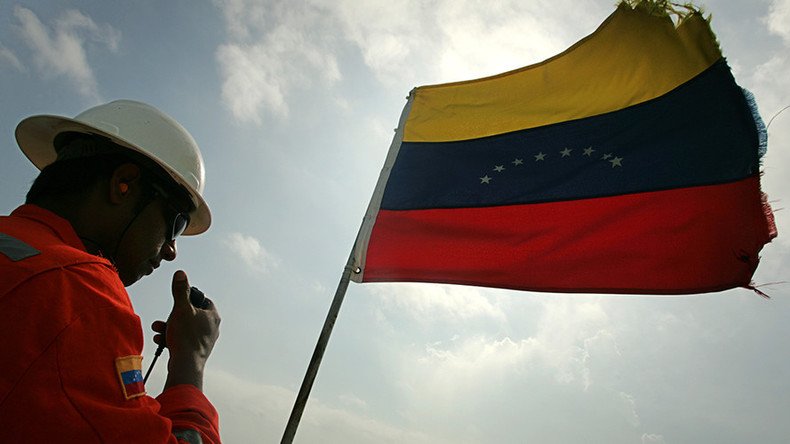

Venezuela’s oil production on the brink of collapse

Desperation is spreading in Venezuela as violent protests continue to paralyze the country, further damaging the country’s shattered economy. Venezuela’s already-decrepit oil industry is deteriorating by the day, and an outright implosion is no longer out of the question.

The inflation rate, according to the IMF, will balloon to 720 percent this year. Food shortages have been common for quite some time, but are deepening and wearing down the population. Three out of four people surveyed by the WSJ reported involuntary weight loss last year. Hospitals have completely broken down.

Venezuela has been crippled by protests since late March, with more than three dozen people having been killed over the past two months, and there is no sign of improvement. This meltdown is taking a toll on Venezuela’s oil production, the last thing keeping the country from becoming a failed state. Venezuela’s oil production has been declining for more than a decade, mainly because oil revenues are used to finance the government, leaving little for state-owned PDVSA to reinvest in its operations.

But things are getting worse. The cash shortage is accelerating the decline. As of April, oil production stood at 1.956 million barrels per day (mb/d), down 10 percent from last year, and down more than 17 percent from 2015 levels - and output continues to trend downward. James Williams, energy economist at WTRG Economics, told Marketwatch in March that he expects Venezuela to lose another 200,000 to 300,000 bpd this year, another 10 to 15 percent decline from 1Q2017 levels.

Read more on Oilprice.com: Iraq Agrees With Deal Extension, But Boosts Oil Exports To Record Levels

The problem is downstream as well, as the shortage of refined products worsens. Three out of Venezuela’s four oil refineries are operating significantly below capacity because of the inability to find spare parts for maintenance, according to Reuters. The Paraguana Refining Center, for example, is only producing 409,000 bpd compared to its nameplate capacity of 955,000 bpd. PDVSA’s third largest refinery, which has a capacity of 187,000 bpd, is operating “at minimum levels due to problems at two of its three distillation units,” Reuters says.

With cash drying up, PDVSA is also struggling to import lighter fuels that are necessary to blend with the country’s heavy oil. Some ships are sitting off the Venezuelan coast because of unpaid bills. Meanwhile, because of obligations to creditors, PDVSA is sending crude abroad, leaving little for domestic refining.

But PDVSA’s financial and operational problems have a compounding effect. Falling production at refineries mean more gasoline needs to be imported from abroad, putting a tighter squeeze on state finances, which in turn leaves even less for everything else the country needs, from food to healthcare.

Read more on Oilprice.com: Oil Prices Set To Rise On Back Of OPEC Deal Extension

The possibility of all hell breaking loose is not zero. The WSJ reports that Venezuelan security forces are at their breaking point. Young, underpaid members of the national police are often not given food or water while on duty, and are asked to constantly beat back rapidly escalating protests in scorching heat, around the clock. Also, police and soldiers are not immune to the food shortages and economic collapse that the rest of the country is suffering through. The loyalty of the security services to the President no longer appears rock solid.

PDVSA and the national government avoided a debt default a few weeks ago, but with obligations looming later this year and a dwindling pile of cash with which to draw upon, the problem is not going away.

As far as the oil sector goes, the best case scenario for Venezuela is steady, if rapid, decline in production – a loss of 200,000 to 300,000 bpd this year. But the darker scenario is a much more sudden disruption if the country implodes. There is no way of knowing if this will happen, but analysts are growing increasingly concerned about the possibility.

“Oil production continues its downward drift due to service provider cuts, power shortages, inability to obtain imports and irregular salary payments,” Helima Croft, commodities strategist at RBC Capital Markets, wrote in a recent report. “The oil question is whether current conditions could set the stage for the type of industrial action that cut exports by nearly 80 percent in the early 2000s.”

This article was originally published on Oilprice.com