Bitcoin implosion could ‘spill over’ into stock market – Wells Fargo

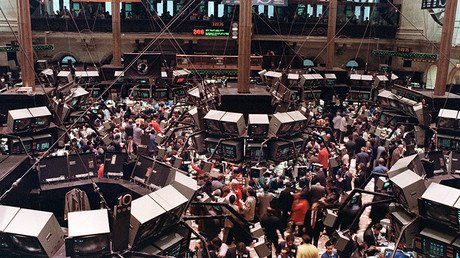

Stocks could easily get dragged into chaos if the cryptocurrency boom goes bust, according to Wells Fargo Securities, which warns the unusual activity in the crypto market could lead to one of the most epic bubbles of all time.

“There is a significant amount of froth in the crypto markets. We do think that if that froth comes out, it will start to spillover,” Christopher Harvey, the firm's head of equity strategy told CNBC.

The recent wild rally of bitcoin and its peers has sparked warnings that investors need to beware that they are not risking a repeat of the 17th-century tulip mania bubble.

Bitcoin has fallen more than 25 percent from its all-time highs of $20,000 spurred by futures listings on major derivatives exchanges. The virtual currency’s slump last week has made some of its supporters revise their projections. Even billionaire Michael Novogratz who had predicted bitcoin would rise to $40,000 by 2019 and was very bullish on cryptocurrencies, updated his forecast, saying bitcoin could drop to $8,000 by year-end.

The Wells Fargo chief said he was worried a cryptomarket crash would start affecting equities. “You're seeing it a little bit, but just not to a large degree. And, it's something to watch out for in 2018.”

Talking about the stock market, which is poised to have its best year since 2013, he said: “You have to lower your expectations for next year.”

“A lot of good news is already priced in, and we just don't see that much going forward. It'll be a decent market, it just won't be a banner year,” he explained.

According to Harvey, the first half of the year will be stronger than the second.

US stock market has 70% chance of crashing... now! - research https://t.co/GVJVOfVrEopic.twitter.com/m0IHRnKNju

— RT (@RT_com) November 28, 2017

He has predicted that by that time stocks will come up against new challenges, whether the crypto market implodes or not.

“What the market will have to contend with is EPS [earnings per share] peaking, ISM [International Securities Market] potentially peaking, you're going to have the yield-curve in all likelihood flattening — and in addition to that, you'll likely have multiples start to compress,” Harvey said.

“You're going to have to scratch and claw to stay afloat for it to break even,” he added.