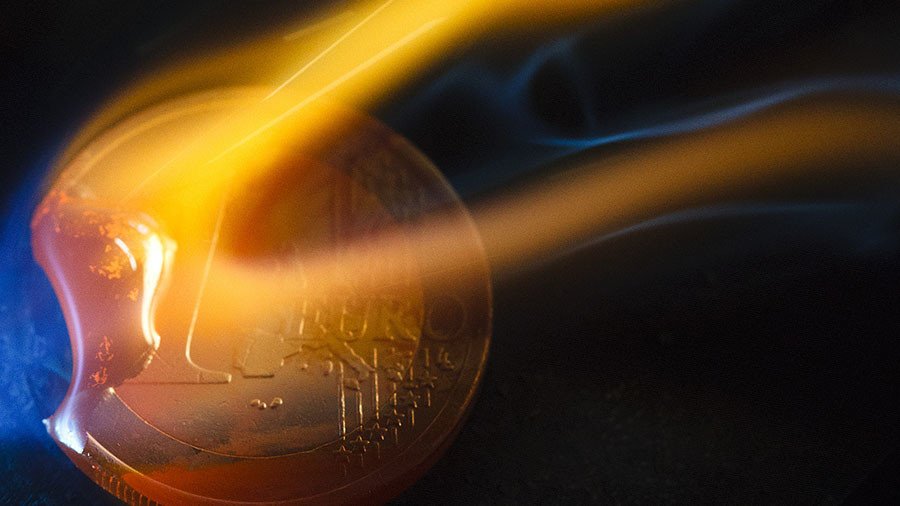

Death knell tolls for the euro as more European nations repatriate gold – expert to RT

The latest trend among European countries of bringing home their gold reserves has been raising concerns in Brussels. RT talked to Claudio Grass of Precious Metal Advisory Switzerland to understand what’s behind that trend.

According to Grass, the process means disintegration, which usually comes with instability, unrest, more government intervention and control.

“The central banks started the repatriation already a few years ago, meaning before we had Brexit, Catalonia, Trump, AFD or the rising tensions between the Politburo in Brussels and the nations of Eastern Europe,” he said.

Grass explained that these are all symptoms that are evident today and “therefore the central banks might have seen this coming long before the public realized it.”

He said it is fair to say that the world is moving away from a centralized system.

“If we follow this trend, it should be obvious that the next step should be an even bigger break up into smaller units than the nation states. With such geopolitical fragmentation comes also the decentralization of power.”

Analysts have pointed out that EU countries see gold as insurance in case they end up returning to their national currencies. According to Grass, only a fool believes you can create wealth out of nothing, and use that as a basis for a sustainable system.

“Our system is based on 7 percent paper notes and 93 percent digital units backed up by nothing other than central bank promises to pay back the debt in the future through inflation and taxation.”

He explained that in the Western world, the government is forcing people to give up between 35 and 65 percent of their income and to put it into mandatory vehicles such as pension funds, retirement insurance, taxes, and so on.

“If you take away 100 percent of a person’s fruits of labor it is defined as slavery… So there is still some room but it doesn’t look good either.”

Grass added that with the “accelerating disintegration of the Eurozone and more nationalistic and right-wing parties popping up that have a clear policy, that is going against the EU.”

“It is just a matter of time before the Euro, the most artificial currency ever, is going to collapse,” he concluded.

For more stories on economy & finance visit RT's business section