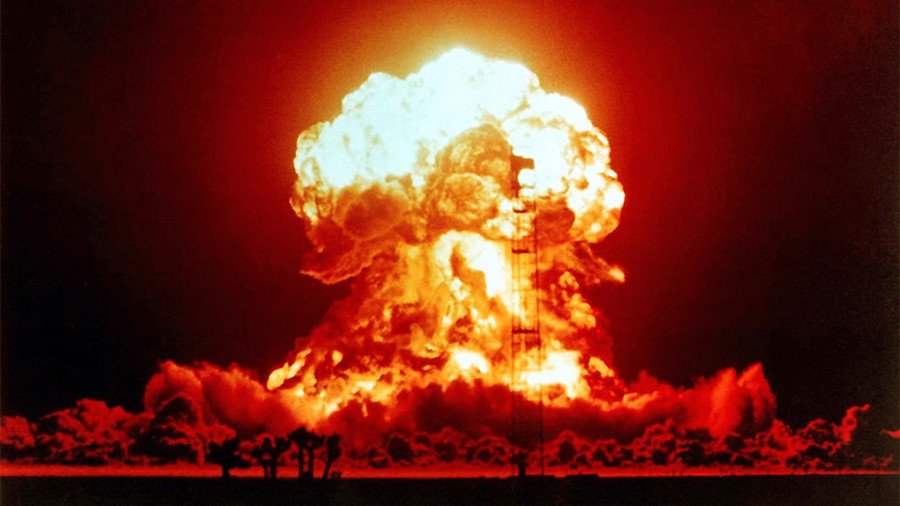

China holding Treasuries ‘nuclear option’ open in trade war with US

Beijing is by far the largest holder of US Treasury bills, meaning it can affect their price and yield. It could be China's trump card in the trade war with Donald Trump.

As of January 2018, China held $1.168 trillion in American debt, more than a $100 billion increase since the same time last year, but down about 11 percent from the record high above $1.3 trillion in late 2013. That's 19 percent of all US Treasuries, notes, and bonds held by foreign countries.

Beijing increased its holdings of US debt last year by the most since 2010. China’s foreign exchange reserves were about $3.13 trillion at the end of February, with roughly a third of them held in US Treasuries.

However, if China seeks to manipulate the United States in a trade war, it would be well advised not to sell them, analysts say. “If they wanted to pull the nuclear switch, if they committed to dumping Treasuries, it would have an immediate and temporary impact on money markets in the United States,” said Jeff Klingelhofer, a portfolio manager who oversees more than $6 billion at Thornburg Investment Management, as quoted by Reuters. “But I think it is a bigger hit to the sustainability of what they’re trying to accomplish.”

Jeffrey Gundlach, the chief executive of DoubleLine Capital LP, agrees, saying that US Treasuries can be used by China as a leverage. “It is more effective as a threat. If they sell, they have no threat. It would only escalate the situation and eliminate their leverage,” he told the news agency.

Chinese officials said in January that the government is considering slowing or halting purchases of US Treasuries as they have become less attractive relative to other assets.

Some analysts have said that by buying US Treasuries over the years, China has artificially depreciated its currency. A weaker yuan makes Chinese exports cheaper for buyers, and thus boosts trade.

For more stories on economy & finance visit RT's business section