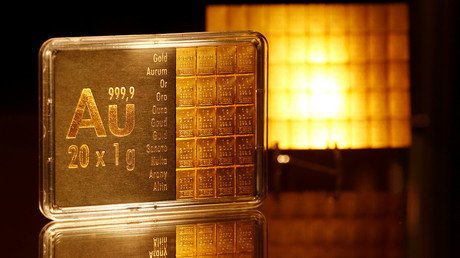

Small Asian nation dumps dollar & yuan for gold amid growing global trade hostilities

China’s neighbor Kyrgyzstan has been piling up gold reserves as a hedge against a possible trade war between Beijing and Washington.

The country is seeking to boost the share of gold in its $2-billion international reserves to 50 percent from its current 16 percent.

“The rules of the game are changing,” Kyrgyz Central Bank Governor Tolkunbek Abdygulov told Bloomberg in an interview. “It doesn’t matter what currencies we have in our reserves; dollars, yuan or rubles all make us vulnerable.”

The Kyrgyz currency, the som, slumped to a record low in 2015 following steep depreciation of the Russian ruble amid an oil crisis and stand-off with the West. Since then, the country boosted the share of gold in its reserves from 8 to 15 percent.

Gold is Kyrgyzstan’s largest export. Since 2014, the country’s central bank has been buying up as much of the country’s gold as possible, Abdygulov said.

“If we decide to sell gold, then we can easily sell it and convert into the currency we need,” Abdygulov said. “Taking into consideration that we mine a lot of gold in our country, it’s God-given that we should keep a large part of our reserves in gold.”

For more stories on economy & finance visit RT's business section