Global airlines face huge losses due to grounding of Boeing 737 MAX 8

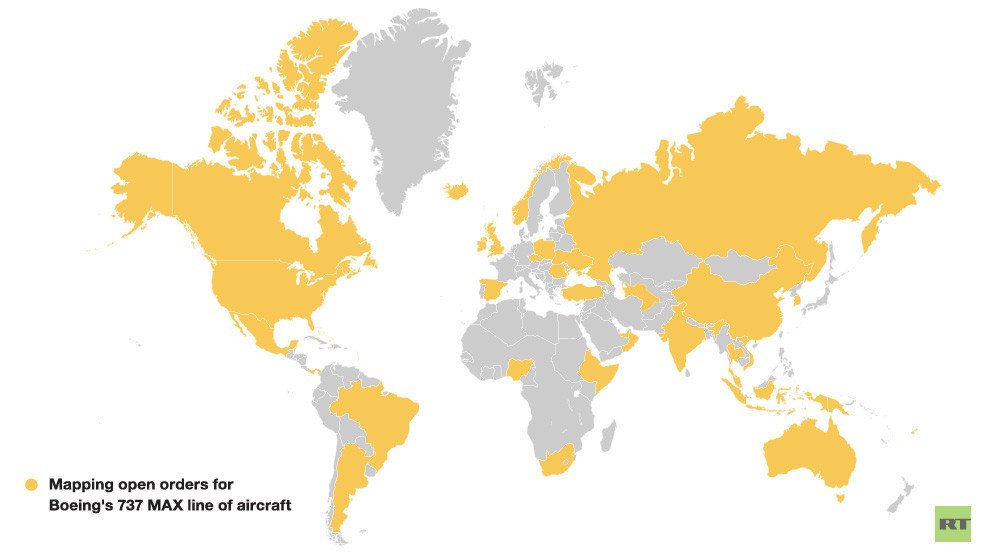

The latest crash of Boeing’s best-selling passenger jet has sent shockwaves through the entire airline industry. Dozens of countries grounded the 737 MAX following national regulators’ requirements.

The aircraft saw two deadly accidents in less than five months. Sunday’s tragedy in Ethiopia took the lives of 157 people. The crash in Indonesia in October killed 189 people.

The narrow-body Boeing 737 MAX 8 that hit the market in 2017 has been generally recognized by dozens of air carriers across the globe for its bigger engine and improved fuel efficiency in comparison with previous versions. According to the producer, 355 MAX 8 jets were operated by global carriers as of January 31, 2019 with 5,123 total orders for the aircraft. The average price of the unit reportedly reaches $121.6 million.

Also on rt.com Trump grounds troubled 737 MAX aircraft, Boeing stock tumblesBoth crashes involving MAX 8 planes are currently under investigations that could take months to complete. RT has decided to look into potential losses for the air carriers that have the most MAX jets in their fleet in the worst case scenario that may include full grounding and a halt to the deliveries of the plane.

Chinese air carriers reportedly accounted for about 20 percent of 737 MAX deliveries worldwide through January. On Monday, the country’s aviation regulator ordered national operators to ground nearly 100 planes. The move reportedly hit 29 international and domestic flights on Monday alone, forcing the airlines to replace the plane on 256 other flights that had been scheduled to use it.

The US carriers are reportedly the second biggest outlet for the world’s largest aerospace group. Late on Wednesday, US President Donald Trump ordered to ground all Boeing 737 Max airplanes, citing safety concerns. The US was among the last holdovers in grounding the controversial jet.

Previously, US Federal Aviation Administration hadn’t put any restrictions on the use of the 737 Max 8s by domestic carriers despite two fatal crashes. The agency had said the model was airworthy. Boeing had also refused to ground the aircraft.

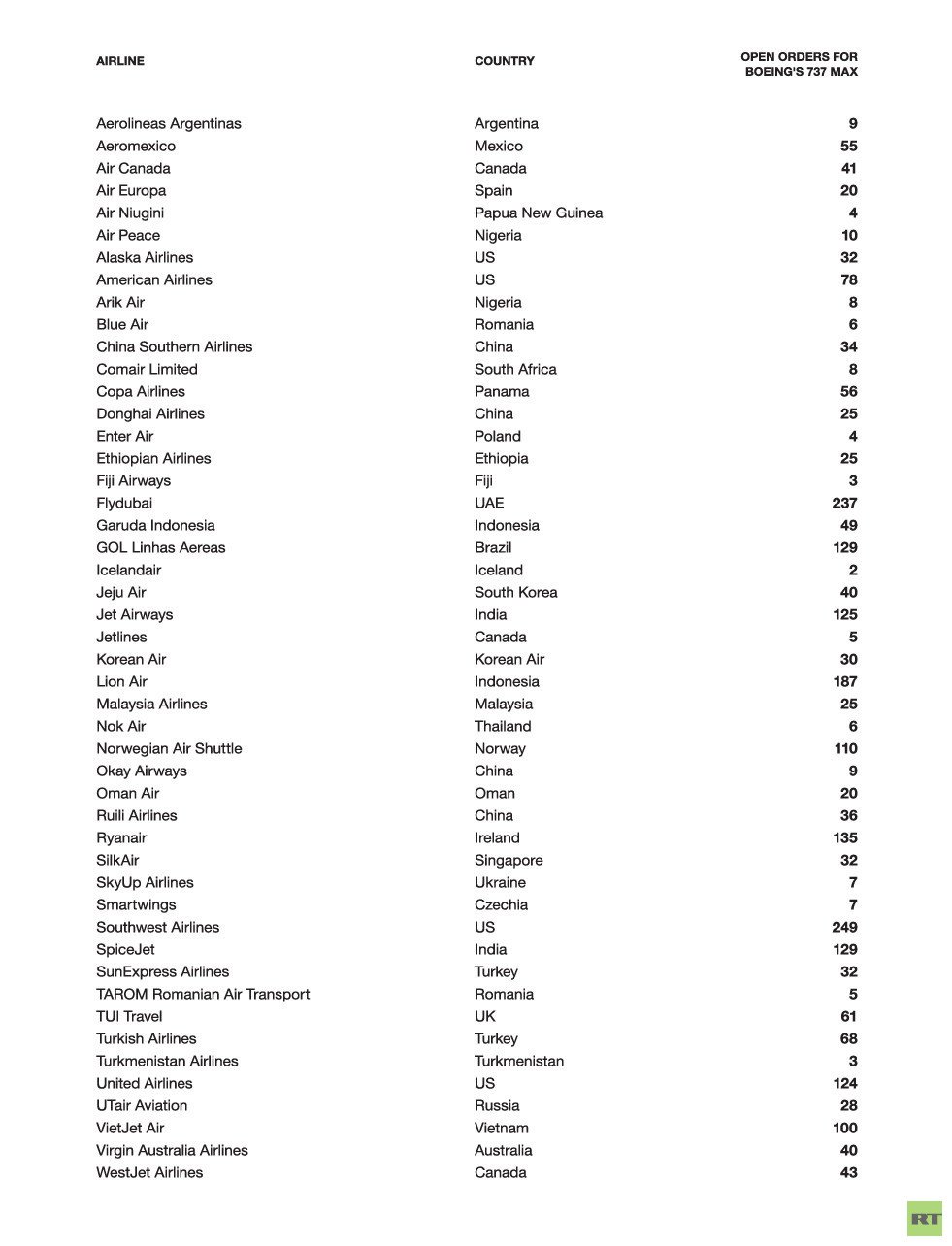

Meanwhile, Dallas-based Southwest Airlines is operating 34 of the aircraft with the number of orders reportedly totaling 249. American Airlines orders reportedly totals 78 with the carrier flying 22 planes, while United Airlines placed orders for 124 jets with 12 planes in its current fleet.

Emirati low-cost airline Flydubai is also among Boeing’s biggest customers. With 11 aircraft currently in service, the airline reportedly has 237 planes on order. The company had to ground its Boeing 737 Max 8 and 737 Max 9 aircraft following the directive issued by the United Arab Emirates General Civil Aviation Authority.

Indonesia’s Lion Air, which had the MAX jet crash in October, has reportedly ordered 187 units of the aircraft. Earlier this week, the airline grounded its remaining MAX fleet after the second crash in Ethiopia.

Also on rt.com ‘Boeing in big trouble’ for not immediately grounding jets – aviation law expert tells RTLow-cost airline Norwegian Air Shuttle which had been operating 18 of Boeing’s 737 MAX 8 jets before it was forced to ground them also announced plans to demand financial compensation from the producer. Norwegian reportedly has 110 MAX jets on order.

Air Canada, which is operating 24 planes of the type, has reportedly ordered 41 jets of the 737 family. So far, Canadian authorities refused to place any ban on using the aircraft despite the latest tragedy.

Irish low-cost carrier Ryanair is not currently operating any 737 Max 8 planes. However, the company has reportedly placed an order for 100 jets.

Airlines stand to lose billions from the grounding of one of the world's most popular planes as they scramble to find replacement aircraft. Smaller carriers may suffer much bigger losses, as they do not have as many alternatives in their fleet as their larger rivals.

For more stories on economy & finance visit RT's business section