Forget gold: Palladium is the undisputed precious metals champion

Palladium has continued this year’s rally, surging to a new record on Tuesday amid rising worries about shrinking supply. It has continued to beat gold and silver as the best investment among precious metals.

Spot palladium was up around 0.5 percent at $1,591.5 an ounce as of 07:57am GMT, after touching its highest price ever of $1,594 earlier in the session. Tuesday’s gains followed a rise of 1.5 percent on Monday.

Palladium prices have been hitting new records almost each month, and in February it surged above $1,500 an ounce for the first time.

The metal has already gained about 26 percent for the year, having climbed nearly 90 percent from the mid-August lows. Palladium is in high demand by the automotive industry.

Also on rt.com Rising palladium demand tightens Russia’s hold on precious metal miningIt is widely used in auto-catalysts, converting most of the harmful gases in automobile exhaust into less noxious substances, and its bull run is believed to be driven by supply concerns.

“The demand has been an ongoing narrative for a while. So, the fundamentals are strong and there is an ongoing supply deficit problem,” a senior currency strategist at DailyFX, Ilya Spivak, said as cited by Reuters.

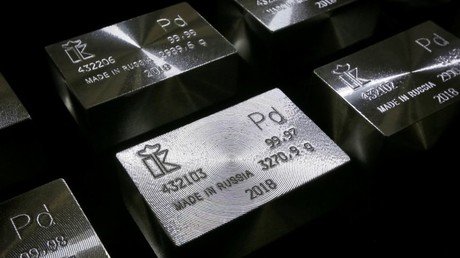

Russia is the one of the leading suppliers of the precious metal, and its mining company Norilsk Nickel is the world’s largest producer of palladium. The firm recently predicted the deficit widening to 0.8 million ounces this year and subsequent rise in demand for the metal.

Also on rt.com Bitcoin investors switching from virtual coins to paper gold, investment strategists sayIn December, the price of palladium overtook that of gold for the first time in 16 years.

Spot gold gained slightly to $1,306 per ounce on Tuesday as the US dollar dipped amid growing expectations that the Federal Reserve would change its policy stance.

“Gold has been edging up and the main driver is a softening dollar,” a market analyst with CMC Markets Singapore, Margaret Yang, said, according to Reuters.

The expert added gold can further firm against the backdrop of the Fed’s decision and Brexit.

For more stories on economy & finance visit RT's business section