What broke the bond between oil and gold?

For decades, two of the world’s most-watched commodities, oil and gold, have typically moved in tandem. But lately, gold has been on steroids while oil prices have decidedly been on Quaaludes.

The big question for traders is whether this is just a separation or an all-out divorce.

Higher oil prices tend to drive consumer prices higher because they increase the cost of making and transporting goods.

On the other hand, holding gold is a favorite way of protecting against inflation.

Also on rt.com Millennials really do ruin EVERYTHING, and Big Oil is NEXTGeopolitical crises or supply disruptions such as the September Saudi Aramco drone attacks also support higher oil prices. High oil prices tend to coincide with periods of high inflation and lower economic growth, while gold is a popular hedge against inflation, thus the positive correlation.

In other words, higher gold prices have in the past meant higher oil prices, although one doesn’t directly cause the other.

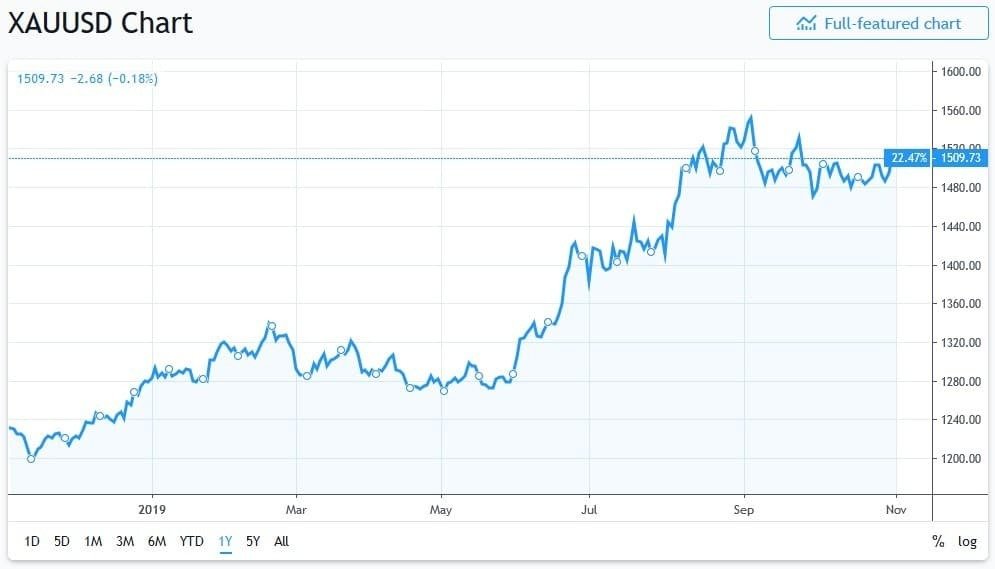

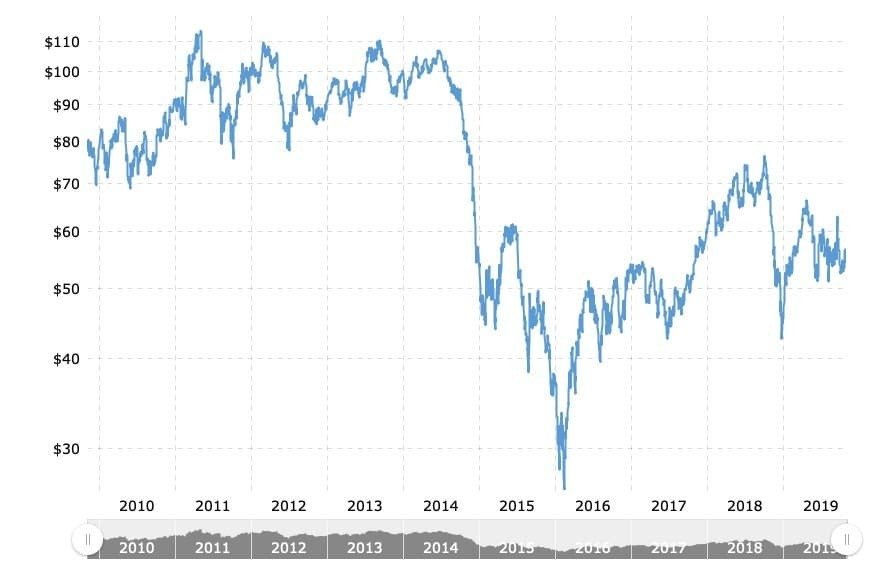

However, this relationship appears to have broken lately with gold rallying 23 percent over the past 12 months, while oil prices have merely been treading water.

Even the massive attacks on Saudi oil facilities failed to move this needle for more than a day or so. In other words, a major 5-percent supply disruption, the biggest ever in history, didn’t help.

So why is the market so fickle? For the most part, it’s no longer got blinders on about geopolitical upsets. There’s an ongoing oil glut and lackluster demand that is clearly entrenched now, so the market isn’t biting when it hears talk of potential supply risks.

Oil is, for the first time in a long time, not hostage to that much sentiment. It’s been hijacked by pure fundamentals.

Gold, on the other hand, is a fully sentimental bet.

Gold-oil ratio

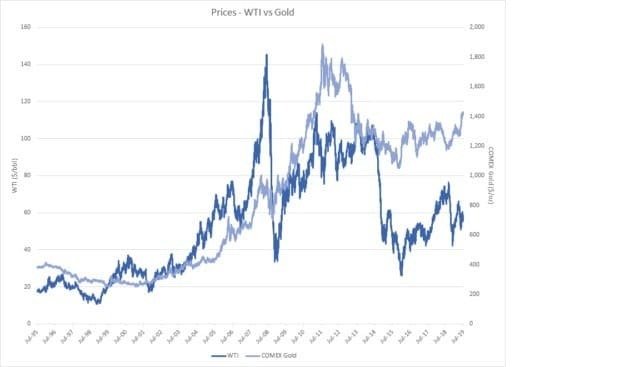

Crude oil and gold prices have in the past largely moved in tandem with occasional disconnects.

The divergence this time around is getting uncomfortably big and suggests something has to give: either gold prices fall or oil prices climb significantly to catch up to gold.

Over the past 25 years, the gold-to-oil ratio has averaged 15.8. What this means is that one troy ounce of gold could buy you 15.8 barrels of US WTI crude oil.

This ratio has been fairly consistent with occasional divergences. The lowest gold-oil ratio over the past 25 years was 6.2 in 2005 when oil prices soared on a demand-driven bull run while gold prices remained low. The highest was 47.6 in 2016 when oil was mired in a serious slump while gold prices remained steady.

The ratio has averaged 24 since the beginning of this year, breaking through 25 in July. With an ounce of gold currently at $1,514.30 and a barrel of WTI crude at $54.24, the ratio is sitting at a multi-year high of 27.9 - or nearly 80 percent above the historical average.

Resetting the ratio

So what really gives? Will the gold-oil ratio reset back to its traditional levels?

Unfortunately, the oil prognosis is not very good.

The remarkable surge in US oil production over the past six years has created a large global supplier that is less susceptible to geopolitical tensions compared to the traditional oil superpowers. Growing exports by the United States is dampening some of the traditional volatility in crude oil prices and capping a good chunk of the market’s price upside.

Currently, the strength of shale supply and growing concerns about low demand growth are weighing more heavily on the market than geopolitics. It’s doubtful whether the risk environment will reassert itself as the key driver of oil prices any time soon as it has been for gold.

The outlook is far brighter for gold.

We appear headed towards monetary debasement and possibly QE.

Gold prices climbed in September when the European Central Bank (ECB) kicked off round 1 of its QE money stimulus. Although the Fed might not grant Trump his wish for further cuts - at least not this year - it has already commenced a program that it expected to gobble up $60 billion of Treasury bills every month (the Fed insists it’s simply expanding its balance sheet and not engaging in quantitative easing). This is likely to keep interest rates low, which is positive for gold.

Also on rt.com Economic uncertainty leaves oil markets paralyzedThe World Gold Council is also quite bullish on gold in its report and encourages investors to allocate more of their portfolios to gold:

‘‘...lower expected bond returns favor additional gold exposure in well-diversified portfolios. As bond yields fall, diversifiers with higher potential returns, like hedge funds, real estate and private equity, carry heavier weights in optimized portfolios. Our analysis also suggests that the historically higher volatility that accompanies these alternative investments, versus other assets such as stocks and bonds, warrants increasing allocations of gold to serve as a ballast in the event of a stock market pullback.”

It, therefore, appears that the higher gold-oil divergence is the new norm - at least in the foreseeable future.

That means that if you’ve been trading on the oil-gold tandem, you’re likely losing.

This article was originally published on Oilprice.com