Russia and Saudi Arabia fight for share of India's huge oil market

Russia has put India on top of its priority list as it looks to ramp up crude exports and expand its downstream presence.

One of the last bulwarks of global crude demand, India has been in the thick of national NOCs’ attention – Saudi Arabia will from now on participate in India’s Strategic Reserves and has signed up to build a greenfield 1.2mbpd refinery in the state of Maharashtra, the UAE-based ADNOC has joined Saudi Aramco in its refinery project and is seeking further investment opportunities. Ever since Rosneft bought the 400kbpd Vadinar Refinery (now known as Nayara) from Essar Oil in 2017, Russia has been present on the Indian downstream market – this acquisition turned out to be one of the crucial elements of President Maduro’s survival in Venezuela, as Nayara was the top outlet for PDVSA crude. Three years on, Russia wants a bigger share.

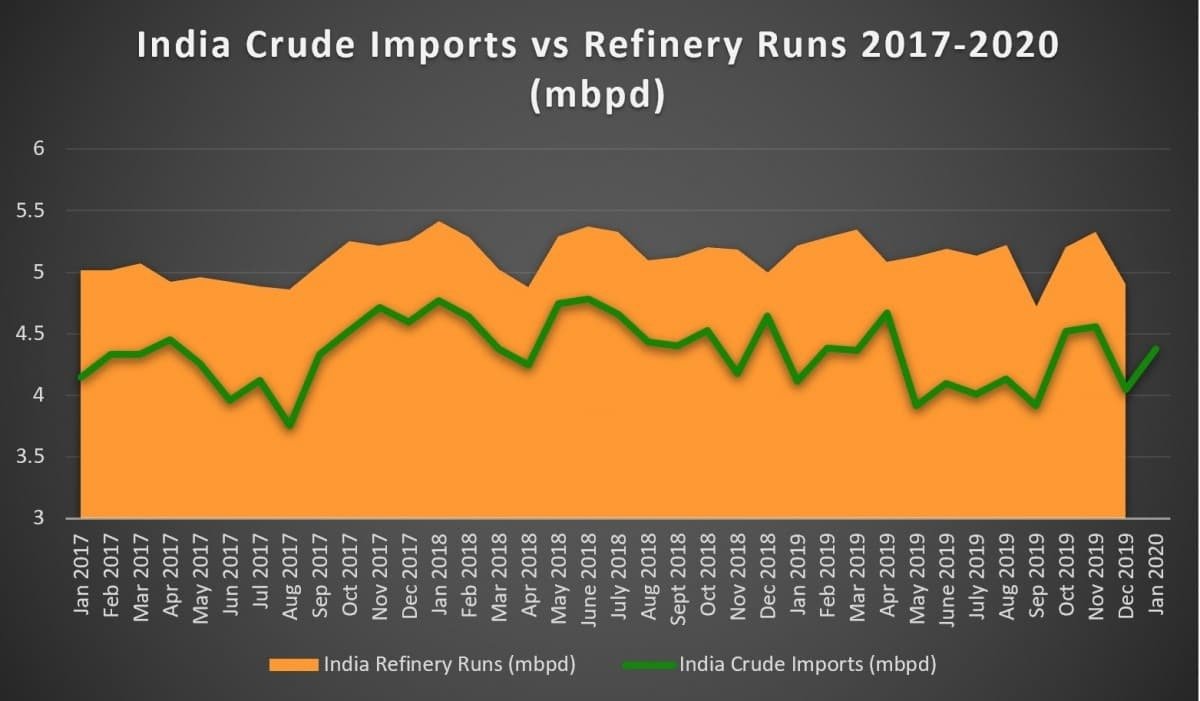

At first sight, India is the ideal place for large-scale downstream investment. Domestic production, currently at around 850kbpd, makes up for a mere 17 percent of the nation’s consumption and has been gradually declining after peaking at 937kbpd in 2011. Whatever upstream breakthroughs India is counting upon in the Mumbai Basin and other maturing basins, be it from enhanced oil recovery at offshore fields or new discoveries, oil production is unlikely to see a reversal (unlike gas). This evidently bothers Indian authorities to the extent that it has set itself a task to reduce oil import dependence by 10 percent by 2022, yet the opposite is happening – India’s crude import dependence has reached an unprecedented 85 percent by the end of 2019.

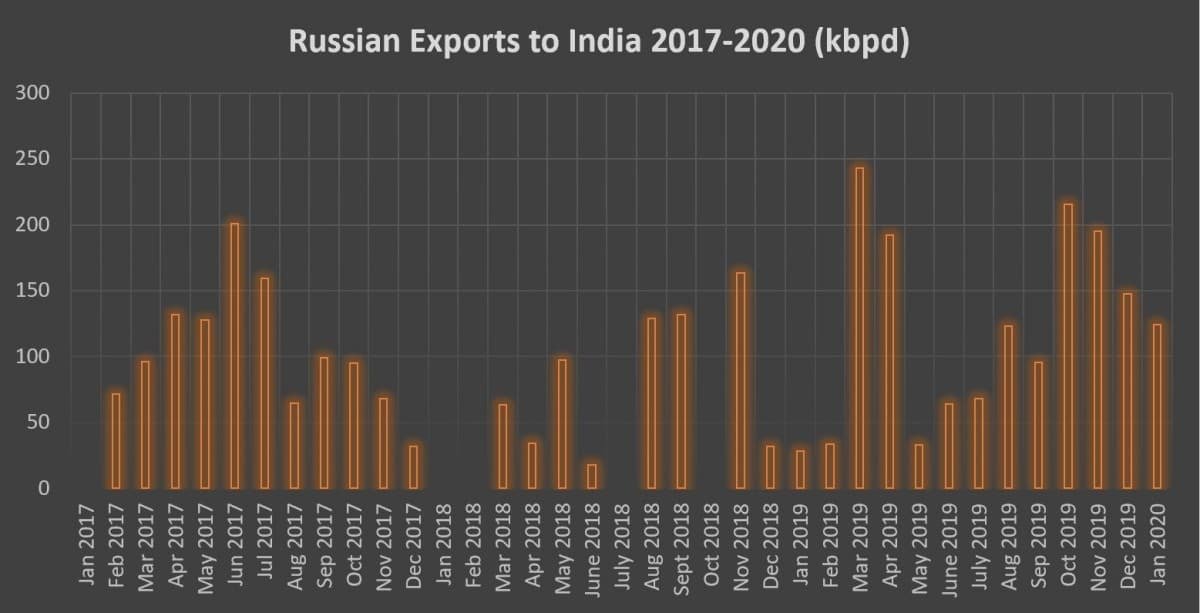

Thus, any major crude producer with a political background strong enough to back up a commercial proposition would dream of locking up parts of the Indian market – its internal market is massive and demand for oil keeps on growing. Compared to traditional suppliers Saudi Arabia and Iraq, Russia is a relative newcomer to the Indian market – it might be even argued that the two nations’ political rapprochement has actually preceded any substantial energy links. Moreover, most of deliveries in 2015 and 2016 which were technically listed as Russian were in fact Kazakhstani-origin CPC – ESPO was too light and consequently too expensive, Urals too distant for the Indian refiner.

Amidst this relative dearth of past successes comes the recent announcement from the Russian NOC Rosneft that it concluded a term supply agreement with India’s state-owned refiner IOC. Rosneft will provide 40kbpd worth of Urals throughout 2020 – equivalent to 2 million tons per year or roughly 15 Suezmaxes. The deal was signed with a lot of government support as India’s Petroleum Minister Dharmendra Phadran was there to sign it, along with Rosneft CEO Igor Sechin. This contract, universally perceived as India’s initiative to decrease its dependence on barrels passing through the Hormuz Strait, will most probably lead to further developments in the Russia-India energy relationship.

Also on rt.com India could become fastest growing energy market by 2030India’s overture towards Russian oil is first and foremost a risk mitigation strategy against any disruption in the Hormuz Strait. India receives a whopping 60 percent of its total crude needs from the Middle East – should any sort of conflagration envelop the region, leading to the closure of the Strait, India would be missing some 2.7mbpd of crude. Two Middle Eastern crude producers stand out – in 2019 India took in 0.846mbpd of crude from Saudi Arabia, lagging only behind the top supplier Iraq, at 1.032mbpd. Hence, one should expect Russian and US exports to the India to be on the increase in 2020-2021, for reasons that eclipse merely financial considerations whilst New Delhi continues to walk the fine line of maintaining a foreign policy equidistant from Russia and the United States.

However, Rosneft’s interest in India will materialize in new forthcoming investments, making the first IOC deal the harbinger of things to come. As a matter of fact, it is not only IOC that has been looking into the possibility of concluding a supply agreement with Russian NOCs – both Hindustan Petroleum and Bharat Petroleum expressed their interest. In the case of the latter it is especially pertinent as Rosneft seems intent to bid for the state’s stake in BPCL (52.98 percent of the refiner) – news which made BPCL shares rally 13 percent in just three days last week. Rosneft still holds the record on the largest-ever foreign investment in India, with the aggregate cost of buying Essar Oil at $12.9 billion. Interestingly enough, Rosneft’s first step to purchase Essar in 2017 was also made by means of a term supply contract, further backed up by a top-level expression of interest.

Rosneft’s motivation is fairly understandable – already endowed with downstream and retail capacities around the country, it could consolidate its India assets and grow even bigger. Were the Russian NOC to buy BPCL, its retail network would reach almost 25 percent of India’s total. India already is a massive market (despite the state of stagnation it has faced in the past year or so) and with India becoming the world’s youngest nation (average age of 29 years) still holds a lot of promise. In contrast, the Indian government wants tangible results in the short term – Modi’s cabinet has set the target of raising $14.5 billion from privatizing company stakes owned by the state. With April 2020, the start of the new financial year, coming soon and still only less than a quarter of the supposed privatization income available, President Modi really needs a bold story to sell.

Rosneft will have to vie with Middle Eastern national oil companies if it wants to get Bharat Petroleum as Saudi Aramco and ADNOC expressed their interest, too. Initially the Indian government wanted Western oil majors, too, to come onboard, however Total expressed its lack of interest in Indian downstream, BP remains hesitant whether the juice is worth the squeeze and American firms seem to prioritize large-scale investments at home. Given Rosneft’s deep ties to the Russian state, the Russian NOC can offer an upstream quid-pro-quo – offering India a larger share in Arctic Oil, its newest project for which it seeks huge tax breaks. Seems a fair price to pay for BPCL’s three refineries with an aggregate refining capacity for 35.3 million tons per year.

This article was originally published on Oilprice.com