Oil price crash sparks a wave of banking mergers in the Middle East

As a result of reduced demand and the fallout from the oil price war, Middle East banks are being forced to merge just to stay afloat.

The historic oil price crash and Covid-19 pandemic have left major producers of the commodity in a deep economic crisis. Dramatic production cuts by OPEC+ has exacerbated the situation by further lowering export inflows for economies that depend heavily on oil dollars. Some, such as the UAE, have tried to put on a brave face by touting the strength of their banking systems and claiming they can withstand shocks of any scale.

Unfortunately, a growing body of evidence suggests pretty much the opposite: A wave of banking mergers is sweeping through the Middle East as the sector scrambles to stay afloat amid slowing economic growth.

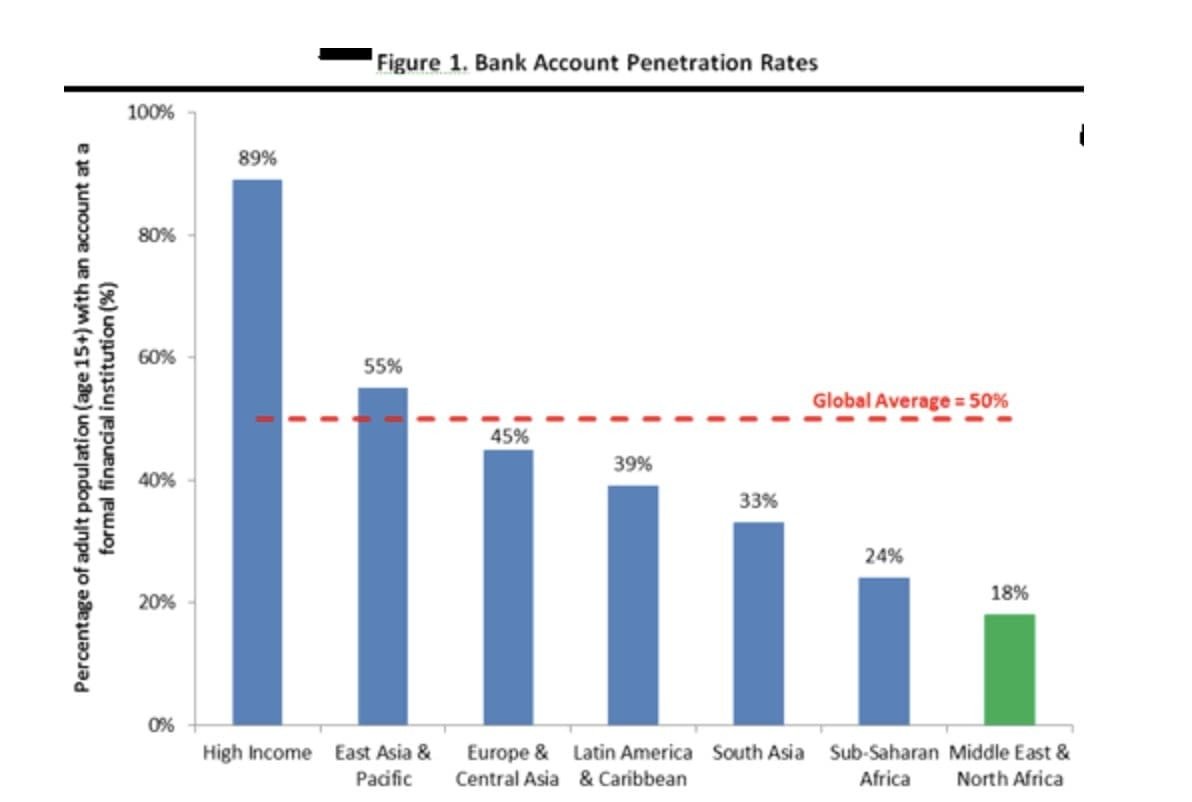

About $440 billion worth of deals are already on the table. That’s a remarkable feat for a region that has the lowest banking penetration anywhere on the globe.

Interestingly, Saudi Arabia--guilty of initiating the oil price war with Russia that triggered the oil price crash--is well represented in the growing trend.

Giant mergers

#1 Saudi Arabia

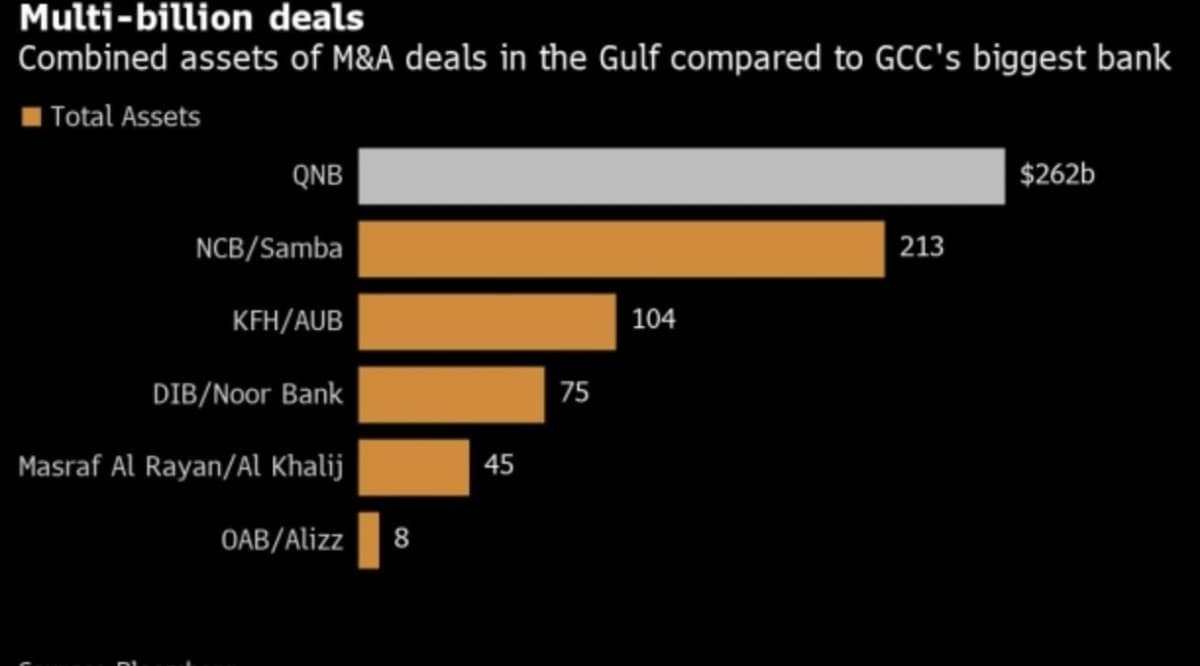

The National Commercial Bank, Saudi Arabia’s largest lender by assets, has lined up a $15.6 billion takeover bid for rival Samba Financial Group. The $15.6B tab represents a nearly 30 percent premium to Samba’s valuation before the deal was announced, while the potential deal will create a $210 billion (assets) behemoth.

The Saudi Arabian Monetary Authority, the Kingdom’s central bank, has unveiled nearly $27 billion in stimulus packages to support its flagging banking system suffering from years of weak private sector loan growth. The Kingdom’s oil and gas sector accounts for 50 percent of GDP and 70 percent of export earnings. The IMF has estimated Saudi Arabia’s fiscal breakeven sits at $76.1 per barrel, a far cry from the current ~$40/bbl.

Also on rt.com Saudi Arabia to take on billions in debt to survive the oil price crisisThe Public Investment Fund (PIF), Saudi Arabia’s sovereign wealth fund, is looking to complete other such mergers to make the sector more competitive. The PIF is NCB’s and Samba’s largest shareholder with a 44 percent and 23 percent slice of NCB and Samba, respectively.

#2 Qatar

In June, Qatar’s Masraf Al Rayan QSC and Al Khalij Commercial Bank PQSC kicked off initial negotiations to merge their operations. The potential merger could create a combined entity with more than $45 billion in assets as well as one of the largest Sharia (Islamic) compliant banks in the region. The deal follows the 2018 tie-up between the country’s Barwa Bank and International Bank of Qatar that saw the proposed three-way merger with Masraf Al Rayan abandoned.

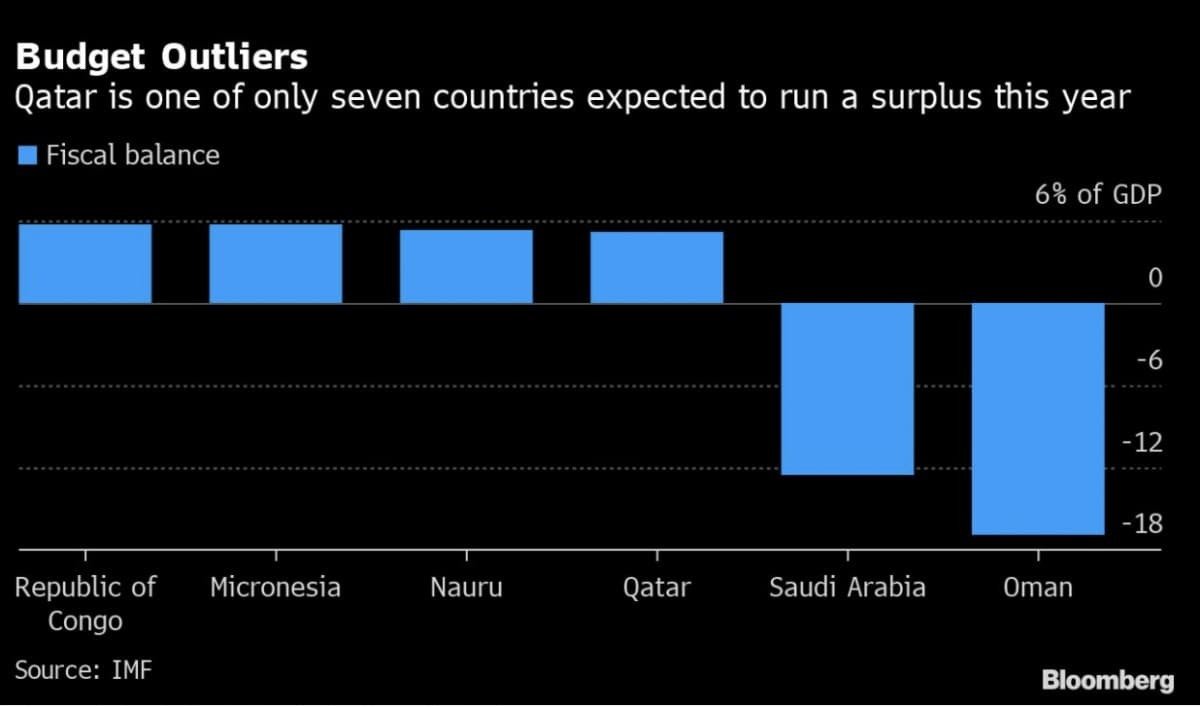

Qatar is the world’s 17th largest producer of oil, pumping 1.5 million barrels of the commodity per day. The country’s economy is heavily reliant on oil, with petroleum and natural gas accounting for more than 60 percent of GDP, 85 percent of export earnings, and roughly 70 percent of total government revenue. Nevertheless, the IMF has tapped Qatar as one of only seven countries expected to run a budget surplus in the current fiscal year thanks to heavily scaling back capital spending.

#3 UAE

In January, Dubai Islamic Bank, United Arab Emirates’ biggest Islamic lender, completed a deal to buy smaller rival Noor Bank in an all-share deal. The combined entity now holds more than $75 billion in assets. The giant bank has since then stolen its competitors’ playbook by courting more international investors and raising its foreign ownership cap to 40 percent.

Although the UAE has one of the most diversified economies in the region, it remains extremely reliant on oil, with the exception of Dubai. The UAE is the world’s 8th largest oil producer, pumping 3.1 million b/d with oil exports accounting for about 30 percent of GDP. The IMF has estimated that UAE needs ~$69.1/bbl to balance its books.

#4 Kuwait

Kuwait Finance House has postponed its planned merger with Bahrain’s Ahli United Bank until December. Kuwait Finance House (KFH) has received a letter from the Central Bank of Kuwait to review the transaction due to the coronavirus. The merger would have marked one of the region’s rare cross-border banking tie-ups and created a combined entity with assets of $104 billion.

Kuwait is an OPEC member and the world’s 9th largest oil producer at 2.9 million b/d. Kuwait’s fiscal breakeven of $61.1 as per the IMF means the country is one of the most adversely affected by the oil price crash though it still has ample back-up in its General Reserve Fund.

#5 Oman

The Oman Arab Bank has finalized plans to acquire local competitor Alizz Islamic after Omnivest, one of Oman’s largest investment funds, sold its 12 percent stake. The combined entity will become a wholly-owned unit of Oman Arab Bank with assets of $8.4 billion.

Oman pumps a million barrels of crude per day, making it the world’s 19th largest producer just ahead of Libya. Like most Middle East countries, Oman is heavily dependent on oil and gas resources for 68 percent of GDP and 85 percent of government revenue. The country is expected to record one of the biggest budget deficits in the current financial year at nearly 20 percent of GDP.

By Alex Kimani for Oilprice.com