India could be the next BREAKOUT natural gas market

Currently, five percent of the South Asian country's energy mix is natural gas. India's massive population and relatively underdeveloped economy signify that there is enormous potential.

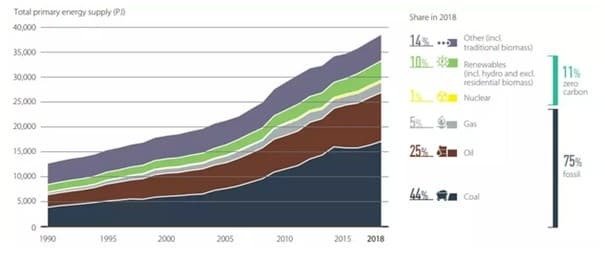

Economic expansion strongly correlates with CO2 emissions as more energy is needed to power factories, transportation, and a higher standard of living. India is not an exception where growth has increased demand for energy. Considerable domestic coal reserves have ensured demand for a steady and secure supply of the pollutant energy source. However, rampant air pollution and global warming require more sustainable sources.

In the long run, renewables are required to fill the demand. Technological limitations, however, require additional sources, for the time being, to ensure a stable and secure energy system. Natural gas is the most suitable option as it’s relatively clean and emits 50 percent less CO2 compared to coal.

With the current trend, India's demand for natural gas could match China's. To make it clear, however, there is a long way to go. Currently, 5 percent of the South Asian country's energy mix is natural gas. India's massive population and relatively underdeveloped economy signify that there is enormous potential.

To put it in perspective, 14 percent of the energy mix is still biomass as a significant part of the country cooks by burning wood or dried manure. Furthermore, the average for the G20 concerning solid fuels (oil, gas, and oil) is 85 percent while India’s is 73. Natural gas usage is also far below the global average.

The health risks associated with high consumption of biomass has convinced the government in New Delhi to stimulate a transfer towards cleaner sources. Low-income families have been receiving subsidies for LPG in rural areas including free LPG-stoves for those under the poverty line. In more urban areas, the government has been pushing for natural gas as infrastructure costs are lower.

Rising demand will most definitely fuel fears of overdependence on foreign producers. Currently, half of India's energy demand is met by imports. Although the closeness to Middle Eastern producers is an asset, political instability, and tensions between, for example, the US and Iran have complicated the situation.

To facilitate these changes in the country’s energy demand, New Delhi has permitted a market price discovery mechanism for domestic gas production. According to India’s energy minister, Dharmendra Pradhan, “the decision will help increase domestic gas production by an additional 40 mn m3/day from the current 80 mn m3/d.”

Also on rt.com India STOPS using Chinese vessels for oil tradeCurrently, the natural gas price in India is a weighted average of several major international gas hubs. According to investors, this mechanism makes a significant increase in domestic production unviable as local costs are not taken into account. Also, the majority of imported natural gas is LNG, which follows a different reality compared with the regulatory environment concerning prices.

Regardless of the challenges, natural gas is an essential source of energy to facilitate the transition towards a system dominated by renewables. The intermittency of solar and wind energy combined with limitations in storage capacity means gas will be necessary to balance the grid.

A substantial increase in production capacity is necessary for India to climb the ladder of economic development. Producers in India had plans to construct gas-fired power plants of approximately 24 GW that would have been powered by a secure supply of domestically produced natural gas.

Disappointing figures concerning discoveries have made it an unrealistic outlook for the short term. The planned construction of the gas-fired power plants has been put on halt for the timing being. New Delhi has a limited number of options to provide sufficient levels of energy while decarbonizing the grid.

Also on rt.com India could become first non‑Arctic state to develop Russia's Arctic resourcesSeveral alternatives are on the table concerning pipeline projects from gas-rich countries in the region. However, political risks create uncertainties for their attainability. Accepting Pakistan as a transit country for Turkmen gas is political suicide in India where fraught relations make any form of dependency unlikely. Furthermore, New Delhi has lately sought to cozy up to the US in light of Chinese assertiveness. Therefore, energy relations with Iran, the world's second-largest gas country, have also been put on hold.

It remains a challenge for India to upgrade its energy system to prepare it for a cleaner future. Despite the challenges, Indian companies are actively engaged across the world. New Delhi secured ‘observer status’ in 2013 for the Arctic council. Indian companies are actively engaged with Russia in the exploration and production of natural gas in the country's Arctic region. India’s energy minister confirmed participation in Rosneft’s massive Vostok project. Therefore, expect the south Asian giant to spread its wings as energy demand, especially for natural gas, rises.

By Vanand Meliksetian for Oilprice.com