Will oil demand recover in 2021?

Oil prices are rallying due to the decision by OPEC+ to extend cuts, but there are still plenty of problems for the oil industry to overcome in 2021.

Oil prices are rallying aggressively on the back of Saudi Arabia’s surprise cut and optimism over the rollout of vaccines across the world. News of a new strain of COVID19, however, has hurt the prospect of a demand recovery in Europe. The big question now for analysts is what does 2021 hold for oil markets?

READ MORE: Oil rallies to 11-month highs on surprise Saudi cuts & US crude supply drop

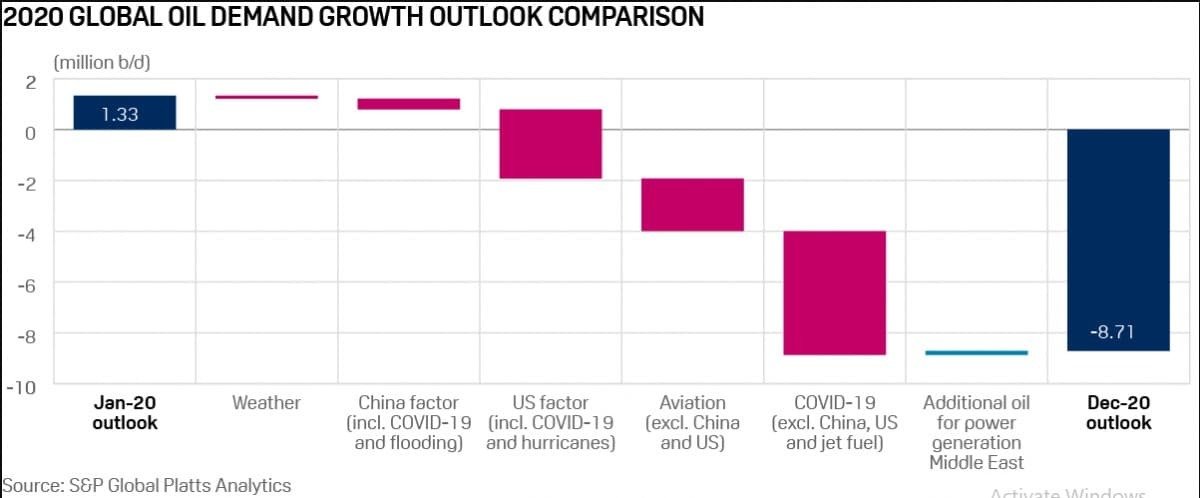

The International Energy Agency (IEA) says that oil demand recovery will be slower in 2021 than previously thought. Reducing its projections by 170,000 barrels per day (bpd), the Paris based agency estimates that oil demand will be 5.7 mbpd in 2021. With reports of new lockdowns across Europe, demand in the transport sector will likely take a hit. Further, with recent flight bans from the UK, jet fuel demand will continue to be under pressure. In fact, according to the IEA, 80 percent of the decline in fuel consumption in 2021 from 2019 levels will be attributed to weak consumption of jet fuel. Analysis by S&P Global Platts suggests that demand will be 2.4 mbpd lower than 2019 levels, coming in at around 5.3 mbpd.

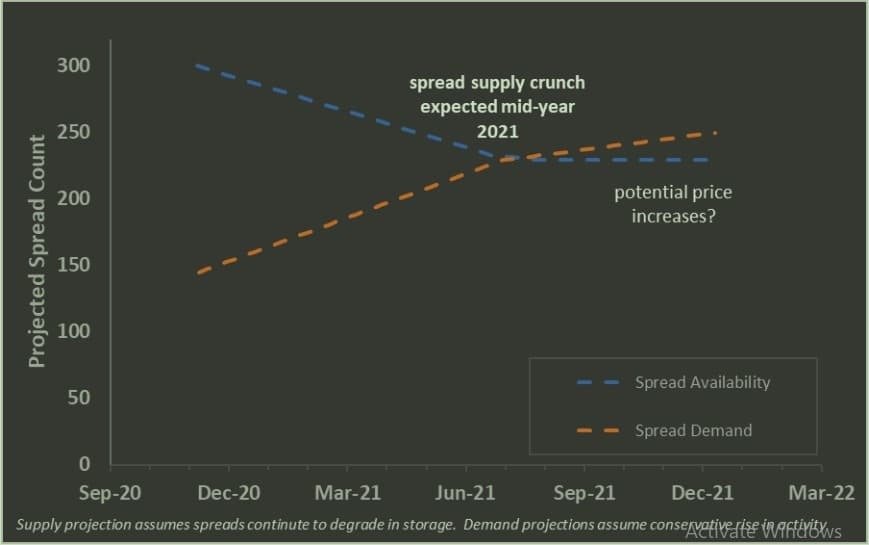

Primary Vision Network (PVN) has also released their End of Year Report for 2021, covering Natural Gas Liquids’ supply, consumption and demand in China, supply profiles by Pumpers, and much more. The PVN report says that they are “cautiously optimistic” regarding demand recovery and E&P activity in 2021. Producers can be expected to continue looking for cost savings where possible. The report points to tense relations between the US and China as adding pressure to global economic activity. The report also highlighted the possibility of a Frac Spread supply crunch. Analysts also highlight how floating storage is rising in the North Sea and Europe while oil in transit is up. Commercial storage is getting crowded as well.

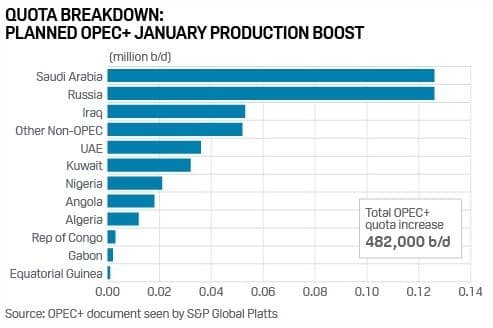

OPEC+ will also remain a key focus in 2021. Libyan production has risen and, according to a recent show by PVN, it could reach up to 1.2 mbpd. Data by S&P Platts suggests that OPEC pumped its most in November 2020, but Russia and Saudi Arabia will have their caps increased in 2021 and could choose to ramp up production. Meanwhile, members that are exempt are already increasing production, with Libya, Venezuela, and Iran adding more than 600,000 to the markets last month. We may expect the trend to continue next year.

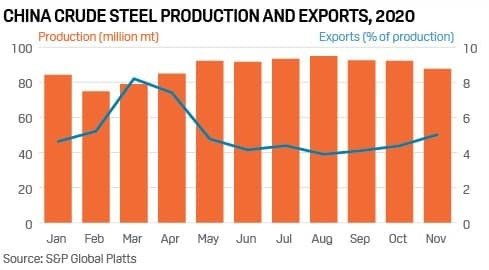

China and its economic health will continue to make headlines next year. China almost single-handedly rescued commodity markets during the pandemic, but its imports are now slowing. The interplay between the US and China will be a vital factor in how the Chinese economy performs in 2021.

Shale production is another significant factor to observe in 2021, with the new Biden administration likely to be less friendly to the oil and gas industry. Saudi Arabia’s recent decision to extend production cuts at the start of the year was very good news for US drillers, but the industry is still in for a tough year if the global pandemic isn’t dealt with and if oil demand doesn’t rebound rapidly.

This article was originally published on Oilprice.com