The restrictions imposed by popular trading platform Robinhood on buying GameStop, AMC, Nokia, and Blackberry shares triggered a huge reaction on social media, with the app receiving over 100,000 one-star reviews on Google Play.

The restrictions came after the platform’s users reportedly coordinated on social media to inflate the value of GameStop and other companies’ stock and inflicted billions of dollars of losses on financial giants that had taken short positions against the struggling companies.

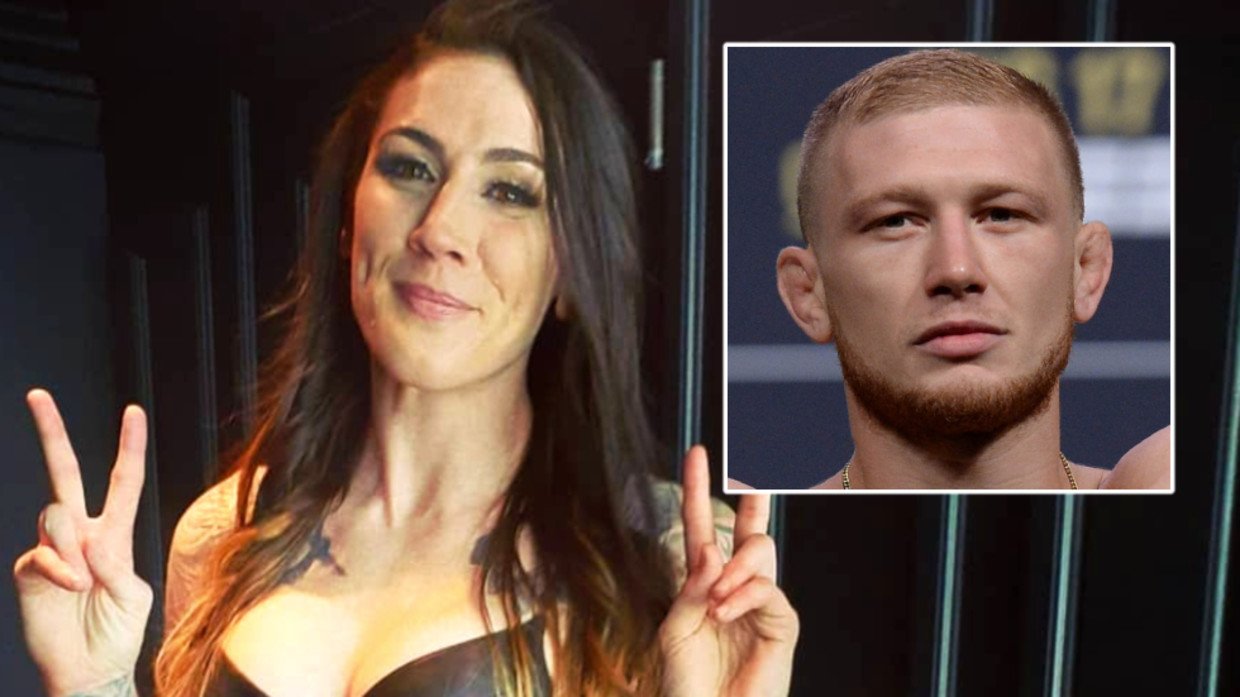

The host of RT’s Boom Bust, Sara Montes de Oca, discusses the hottest financial issue of the day with the program’s co-hosts Ben Swann and Christy Ai.

“The trust in the system is gone, especially for Robinhood,” Christy Ai says.

“They established their platform on the model to empower the ordinary investor, give them access, make it an even playing field.”

The correspondent stresses that, now, everything goes totally against the users, as it’s not a free market anymore, with Robinhood and other brokerage houses enacting their own form of market manipulation by restricting purchases without any warning.

“The only thing you could do, if you are retail trader on Robinhood is you could sell,” the Boom Bust investigative journalist Ben Swann says.

“That means Robinhood didn’t just lock you out of your account, they said the only thing you can do is what the hedge fund managers want you to do,” he adds, highlighting that the retail investors will either lose money by sitting on it or sell it off right now so that it benefits Wall Street fat cats.

For more stories on economy & finance visit RT's business section