Coronavirus pandemic sinks global investment to 15-year low – report

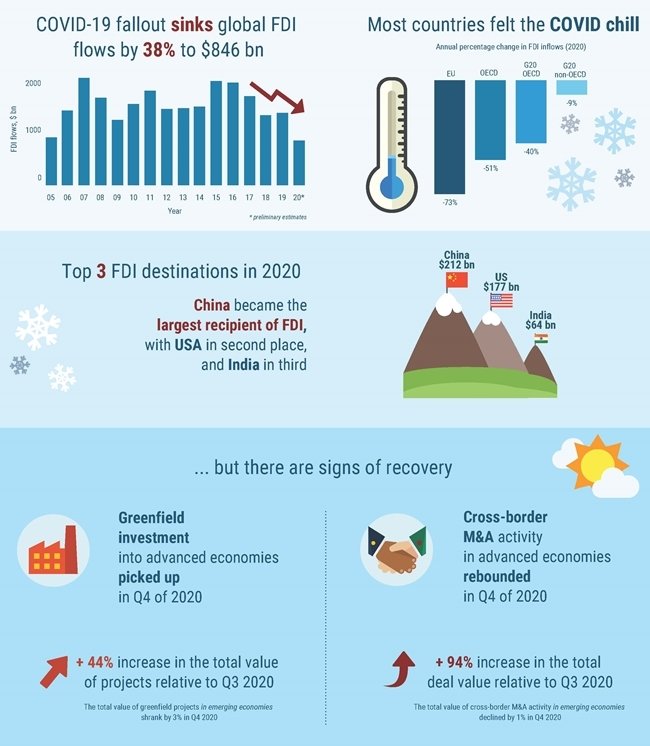

Data from the Organisation for Economic Co-operation & Development (OECD) showed that foreign direct investment flows (FDI) worldwide plummeted to $846 billion in 2020, which is a 38% drop compared to 2019.

The coronavirus pandemic “accelerated a steady decline and contributed to sinking global FDI flows to their lowest levels since 2005,” said the report. In 2020, global FDI flows represented only 1% of world GDP – their lowest level since 1999.

The FDI inflows nosedived in most countries last year, according to the OECD. They crashed by 70% across the European Union, “mostly due to divestments from the Netherlands and decreases that surpassed $10 billion in a number of EU countries.”

Inflows to G20 economies decreased by 28%, while outflows dropped by 43%.

“China overtook the United States as the top destination of FDI worldwide for the second time, six years on. These two economies welcomed FDI flows worth $212 billion and $177 billion, respectively. India and Luxembourg (excluding resident SPEs [special-purpose entities]) trailed behind as the next largest recipients.”

The report also said that the rebound in cross-border mergers and acquisitions activity, “which started in the second half of 2020 and continued in the first quarter of 2021 in advanced economies, with many deals in the healthcare and technology sectors, could boost FDI equity flows in 2021, unless further major divestments take place in 2021.”

For more stories on economy & finance visit RT's business section