‘Apple is not alone’: 18 top American companies avoid $92 billion in taxes

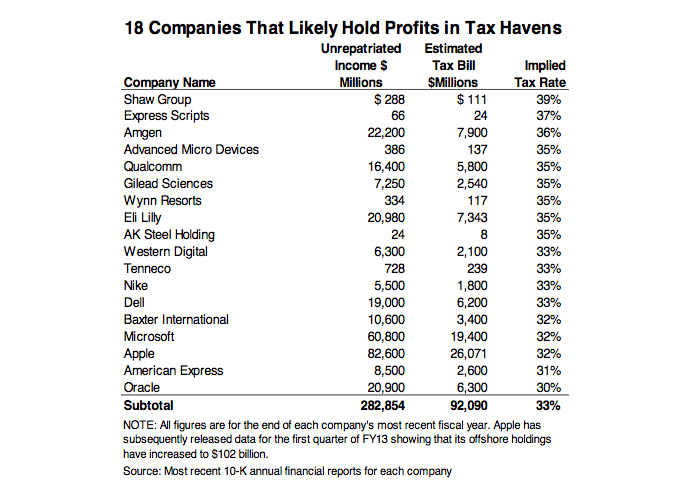

Apple isn’t the only big name company taking advantage of offshore tax loopholes, according to a new study. American Express, Dell, Microsoft, Nike, and other Fortune five hundred companies bear evidence of tax haven profits in their financial reports.

The Citizens for Tax Justice (CTJ), a central-leftist think tank in Washington DC, released a report on Monday which censures 18 other companies also suspected of holding profits in tax havens, declaring in the report's title, ‘Apple is not alone.’

In their latest annual report, Apple disclosed they would pay at least a 30 percent US tax rate on the offshore income if repatriated, which serves as an indication that there is still profit being stashed away in tax havens, such as Bermuda and the Cayman Islands, the report suggests.

The CTJ report outlines 18 corporations’ disclosures which fix an amount to un-repatriated income, in millions, which indicated they have paid very little tax on their profits to any government yet.

According to the report, 55 US companies minimized their tax payments by $127.5 billion by funneling profits through offshore jurisdictions, and would collectively owe the US government this sum if a tax repatriation proceeded.

235 of the Fortune 500 companies are ‘non-disclosing’, which the center calculates holds $720 billion in un-repatriated offshore income. Google, General Electric, Coca-Cola, Wal-Mart, and Cisco Systems are among the ‘non-disclosing’ bloc.

Under the current law, corporations can indefinitely defer paying US income taxes on their offshore profits.

Avoiding or minimizing the payment of taxes, as opposed to evasion is not a criminal offense. However, the authorities have defined tax evasion as immoral and contrary to the spirit of entrepreneurship and law in the US.

Mr. Cook goes to Washington

Mr. Cook, Apple CEO, sat before the permanent Senate subcommittee on May 21st , as they questioned him on why his company had avoided paying tax on $74 billion of profit between 2009 and 2011.

Cook has repeatedly denied Apple uses ‘tax gimmicks’ or has an elaborate offshore profit scheme. Before the hearing, Apple released Cook’s prepared speech which certified Apple was the country’s biggest corporate taxpayer in 2012, and paid nearly $6 billion in taxes.

A two-pronged tax avoidance strategy, Carl Levin (D-MI) the chairman of the committee, coined it, accusing Cook’s company of single-handedly rewriting rules of intellectual property as well as knowingly shielding offshore income from US taxes.

Apple has $102 billion in offshore accounts, shifting profits away from US subsidiaries to Ireland, where it paid a tax rate of less than 2 percent, according to the senate panel report.

Senators John McCain (R-AZ) and Levin suggested the Irish government played an assisting role in helping Apple trim its taxes in a ‘highly questionable’ offshore entity sum which never trickled back to US income taxes.

Ireland has vehemently denied it is a tax haven and on Wednesday called for an international clampdown on multinationals, yet sits at the center of the controversy. Apple Inc. paid just 2 percent on $74 billion in overseas income, which was mostly facilitated by a loophole in Ireland’s tax code.

The ‘Irish double dip’ allows a company to file two subsidiaries in Ireland with a corporate tax rate of 12.5 percent, which is far less than the 35 percent rate in the US, for example.

The theme of Apple, and many other companies use of ‘legitimate tax abuse’ will be discussed by the OECD at the G20 summit in July.