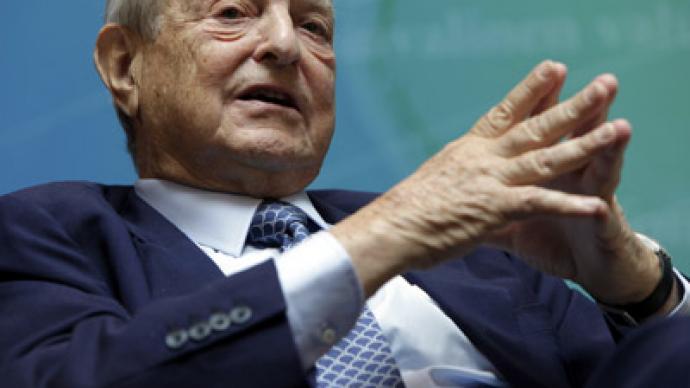

Billionaire George Soros bets on gold as price falls

Billionaire investor George Soros has increased his stake in the biggest exchange- traded fund as gold prices post the largest quarterly drop since 2008.

Soros has nearly doubled his shares in the SPDR Gold Trust from 319,550 to 884,400 as of June 30, compared with three months earlier.The move contradicted his earlier statements when he called gold “the ultimate bubble” and largely dumped his stake in the ETF before gold rose to a nominal high of $1,920.30 per ounce in September. “It may be going higher but it’s certainly not safe and it’s not going to last forever,” he said in a Reuters Television appearance in 2010.Gold slumped 4% in the second quarter as European Central Bank President Mario Draghi and Federal Reserve Chairman Ben Bernanke failed to increase stimulus measures, damping the outlook for global growthAnalysts say that Soros simply grabbed the asset at its lowest level. “Soros is expecting a steady increase in global inflation. If this happens then the price of gold would go up significantly because, as a rule, if global inflation goes up then the currencies will be sliding so people would have to invest in assets, which value is not linked to money”, Vladimir Tikhomirov, chief economist from Otkritie, told Kommersant daily.But some investors say they are not big fans of gold.“When we invest in something we want to get something in return. We want to be able to get the benefit from it and all that happens to gold is it either goes up or goes down,” David Koe from UK’s investing advisor the Motley Fool told RT.“I can have it sitting on my desk and in ten years’ time that lump of gold will still be there but I have no idea what it’s going to be worth”Gold erased its gains this year in May as investors favored sovereign debt and the dollar as economic growth slowed. The media speculates that some hedge fund managers have been known to talk down an investment.It could simply be that Soros has changed his mind regarding gold and stopped viewing it as an "ultimate bubble". Soros has recently warned that there is a real risk of a euro break up. He has also been concerned about the US fiscal situation – both of which are of course bullish for gold.The bilionaire also cashed out of his positions at J.P. Morgan, Goldman Sachs and Citigroup banks but kept his stake in SunTrust Banks.