BP seen as playing tactical tricks to push AAR

The turmoil around BP and Rosneft has turned into a new wave of media coverage after a source suggested that BP may sell its stake in TNK-BP.

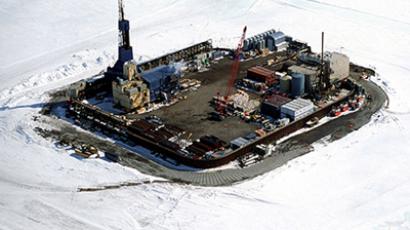

On Tuesday, The Wall Street Journal cited a person close to BP saying the company is taking steps to sell its 50% stake in Russian venture TNK-BP to state-run Rosneft.The move could help the British oil major save its landmark cooperation deal with Russia's largest oil producer giving Rosneft the ability to block major appointments and other decisions within TNK-BP.Rosneft declined to comment, but David Nicholas, a spokesman for BP confirmed that BP has no intention right now to sell any of its shares in TNK-BP. Under the current TNK-BP shareholder agreement, official notification from BP of its intent to sell part of its stake would set off a 75-day period in which AAR could consider whether it wanted to make a counter offer. If AAR decided to do so, it would have a further 90 days during which BP would be required to conduct good-faith negotiations to sell to AAR.Alexei Kokin, analyst at UralSib, said BP is using a tactic trick to push AAR for talks“It’s BP putting pressure on AAR by threatening to bring in Rosneft.” Grigory Birg, an oil analyst from Investcafe, said the deal could help BP improve its financial situation, but it may also be a blow to the company's oil output. “The 50% TNK-BP stake controlled by BP cost $23.35 billion as of June 7. It has been said that BP looks forward to selling a half of its stake in TNK-BP to Rosneft. The feasibility and efficiency of the deal is very unclear taking into consideration that Rosneft in that case could obtain a blocking stake not a controlling stake. AAR will most likely set up another claim to a court and will try to prevent all agreements between BP and Rosneft. I think the main objective of AAR is to sell its TNK-BP stake with a significant premium to the current market price. On the other hand, I do not believe that AAR will allow for 25% shares to be sold to a strategic competitor such as Rosneft. Ultimately, it is a strategic move by BP to negotiate more fair valuation for AARs’ share of TNK-BP. I think negotiations will take place. But the reason why BP is pushing forward with the final decision is that they are very interested in developing the Arctic reserves of Russia within BP-Rosneft Joint Venture.”