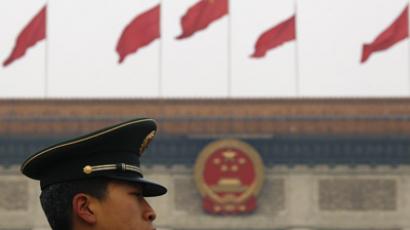

China trade deficit bad news for investors worldwide

News of China’s huge trade deficit has frightened investors out of their wits as they used to consider China a safe haven during times of economic turmoil. They are concerned that China’s slowdown will worsen the global economic situation.

Most Asian markets dipped on Monday after China reported it had a trade deficit while Light crude-oil futures for delivery in April lost 80 cents, or 0.7%, to $106.60 a barrel in electronic trading during the Asian session.Global markets are proving sensitive to Chinese statistics. Last week the commodities fell after China’s Prime Wen Jiabao lowered the country’s growth target to 7.5% from 8%.Given high import numbers from the West, “the slowdown in China will hit exports from the US, the EU and other countries including Russia,” Konstantin Styrin, assistant professor of economics at the New Economic School (NES), told Business RT.On Saturday the Chinese Government reported a $31.5 billion trade deficit in February, the highest level since 2000, after reporting a $ 27.28 billion surplus in January. Exports to the European Union dropped 1.1% in January and February compared to the same period in 2011.The domestic activity in China also demonstrates signs of decline with weaker car sales growth and poorer data on industrial production, property and retail sales. Chinese experts warn against reading too much into the data, as a week-long Lunar New Year holiday in January pushed down the results, with factories closed. But shrinking demand for Chinese goods in the European Union and other Western markets sliding into recession has also contributed to export’s decline in China. However China is unlikely to suffer big losses because of flattering exports, as it was in 2008 when the global crisis cost the Chinese economy 20,000 jobs.Analysts expect China will take measures such as easing monetary policy over the coming months to support growth. The People’s Bank of China has already pledged to react promptly on changes in economic situation."The PBOC will, in light of economic and financial situations, adopt a mix of policy instruments including interest rates, exchange rate, open market operations and reserve requirement ratio, properly use the macro-prudential policy framework, and balance money supply and demand, in order to maintain reasonable growth of the all-system financing aggregate," the PBOC said in a statement.Recently the World Bank advised China to increase dividends from state-owned firms in order to raise bank deposit rates to boost government revenue for social programs.Meanwhile, Styrin thinks opening up the Chinese financial market to more competition would be the ideal solution. “Today the financial sector is dominated by state owned banks, and there’s much doubt that a lot of capital goes to the most efficient users,” the NES expert explained to Business RT.