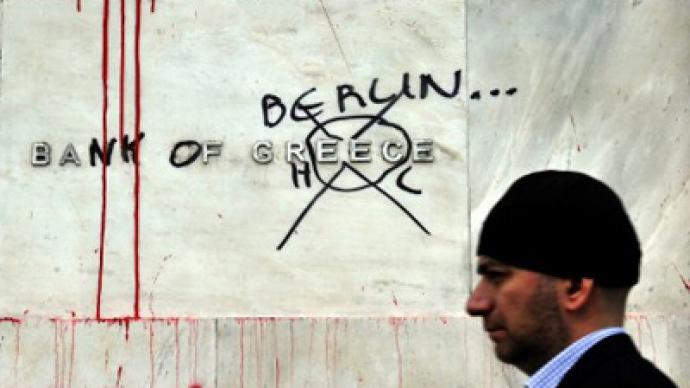

Next on high-risk list after Greece

Cyprus, Ukraine, Venezuela, and Spain are among 10 countries, which are most likely to default on their debt in the near future, according to research by the Markit financial information agency.

The markets have absorbed Greece's financial problems, but they may worry about its neighbor. Cyprus comes first in a line for default as it tops the list of the countries with widest credit default swap (CDS) spreads, indicating investors’ sentiment on a country’s debt. That means investors pay the most in order to secure a return if the country’s loan defaults.The CDS has a spread of 1183 basis points for a five-year Cyprus bond meaning the default protection for a notional amount of $1 million costs $118,300 per year. Portugal unsurprisingly takes second place as its debt burden has been worrying investors for some time. The country’s CDS has a spread of 1075 dropping 90 points compared to April 2011. Ukraine takes third place with a spread 859 basis pointes, which grew 101 points or 13% during the year. The top three are followed by Argentina (809 points), Venezuela (712 points), Ireland (572 points), Hungary (546 points), Egypt (544 points) and Lebanon (459 points).But Spain, which used to be the major headache for investors as well as for EU authorities, was at the bottom of the list with 428 points spread. However, its spread grew 15% or 55 points comparing to the survey last year.Finland and Germany are the least likely eurozone countries to default with the CDS spreads of 66 and 78 basis points, the Markit report reveals.