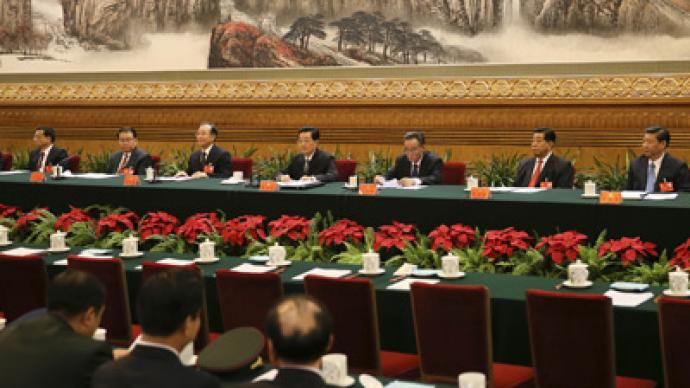

Improving economic data in China to give firm footing for new leaders

Improved factory output and consumer spending in China may be another sign that economic recovery is near. It provides solid ground for the new generation of the country’s leaders who’re set to be named at the ruling party meeting in Beijing.

Factory output grew 9.6% more in October 2012 than a year earlier, with retail sales rising 14.5% from the September figure of 14.2%, according to a Chinese Government report on Friday.Inflation eased further in October, giving Beijing more room to cut interest rates or launch new stimulus measures to speed a recovery with less danger of igniting politically dangerous price rises. Consumer prices rose 1.7%, which marks an improvement from September’s 1.9%. That was mainly due to a gain in food prices, where inflation cooled to 1.8% from 2.5% a month earlier. Investment growth strengthened, going up 25.2% year on year. Estimates for the near future also look bright – the Paris-based Organisation for Economic Co-operation and Development (OECD) said on Friday that China is set to replace the US as the world’s economic leader in the next 4 years. Thanks to better figures for inflation, investment, as well as retail sales, the government saw economic growth as “steady”, despite its fall to a three and a half year low of 7.4% in the quarter ending in September, suggesting there was no need for a further major stimulus.The data is welcome news for the Communist party, which is meeting in Beijing for a once-a-decade handover of power to younger leaders. Coming off the past year's steady declines in economic activity, a rebound might allow the new leaders to benefit from improving public sentiment. The Communist Party Congress is largely expected to install Vice President Xi Jinping as party leader and China's next president.Beijing launched a mini-stimulus early this year, cutting interest rates twice in June and July and stepping up investment by state companies, as well as spending on building airports and other public works. But authorities avoided bigger measures after their huge spending in response to the 2008 global crisis fueled inflation and a wasteful building boom. “All appearances that these are governmental measures to support crediting in the country and stimulate consumer activity there that produce effect – strengthening of retail sales sector gives the basis to expect positive dynamics in the related sectors,” commented Anna Bodrova of Investcafe.Forecasters expect growth to rebound this quarter or early in 2013. They say any recovery is likely to be gradual and too weak to drive global growth without improvement in the United States and Europe. While global GDP will be adding an average of 3% each year over the next 50 years, a huge variation between countries and regions will persist, the OECD report said. By 2025 the GDP of China and India put together will be bigger than a combined one of France, Germany, Italy, Japan, UK, US and Canada.