US Fed slashes debt purchases by another $10 bn

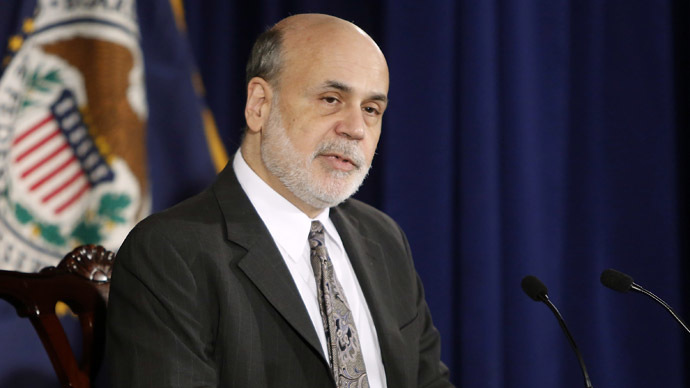

The US central bank will reduce bonds purchases to $65 billion per month, Ben Bernanke said Wednesday at his last meeting as Chair. No comment was directed at emerging markets, which are highly sensitive to US monetary policy.

The Federal Open Market Committee (FOMC) said it would buy $65 billion in bonds per month starting February, down from $75 billion now. The statement says the $10 billion-per-month reduction is not necessarily a set course to be repeated at each monthly meeting.

"Asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases," the statement said.

As the committee has said before, they will keep inflation rates low until the economy is close to full employment.

There was no mention in the statement on spillover effects in emerging markets, which have experienced great turmoil since the US announced it would begin to taper its bond-buying.

Steadily rising economic factors, apart from lukewarm unemployment at 6.7 percent and January's disappointing jobs report (only 74,000 jobs added), have pushed America to ditch its stimulus. Exports, manufacturing, and sales helped the economy expand 4.3 percent in Q3 and probably over 3 percent in the last quarter.

Janet Yellen, the first female to serve as Chair of the US central bank, will take over the post this Saturday. She is expected to continue Bernanke’s legacy and continue to scale back the amount of government debt the Fed buys through bonds.

At last December’s meeting, Bernanke announced America’s bond buying program was being reduced to $75 billion from $85 billion.

It was Bernanke’s last meeting as Chairman of the Fed, and he will be remembered as the man who saved America from a second Great Depression with quantitative easing, which drove interest rates low enough to keep stocks on Wall Street afloat. The Dow Jones Industrial Average finished up 26.5 percent in 2013, the biggest leap in the last 16 years.

“I think he’s going to go down as one of the greatest Fed chairmen of all time,” said Henry Paulsen, former Treasury Secretary who worked closely with Bernanke in the high-pressure days leading up to the government’s decision not to bailout Lehman Brothers.

The Fed’s easy money program has been pumping billions of dollars into the economy by simply printing money, which propped up equities and markets after the 2008-2009 financial crisis. Under Bernanke, interest rates reached all time lows.

A chief complaint about Bernanke, especially the massive stimulus money, is that his policies didn’t trickle down to Main Street, but only made the rich richer. Ex-Fed banker Andrew Huszar is one of the most outspoken critics of quantitative easing, which he admits saved financial markets but didn’t help average Americans pay off their mortgages or find jobs.

Under Bernanke, monetary policy "did a wonderful job of keeping the financial system from falling off the table," Jack Ablin, chief investment officer at BMO Private Bank in Chicago told the Los Angeles Times.

"But as a side effect or consequence, it's driven a wedge between the haves and have-nots,” said Ablin.

Emerging Markets

Since Ben Bernanke first uttered the words "taper" in May 2013, emerging markets have gone haywire in preparing for the instability and risks that a stronger dollar spells for them.

However, they have had time to prepare, as the US didn’t cut off stimulus spending until December 2013. The International Monetary Fund (IMF) released a statement Tuesday suggesting the plight of emerging markets needs to be examined internally, as tapering isn’t the only element offsetting global markets.

Jose Vinals, the director of the IMF’s monetary and capital markets department, on Tuesday said the volatility in global markets is actually caused by problems in particular developing countries and not linked to the U.S. Federal Reserve's decision to reduce its monetary stimulus, the International Monetary Fund's top financial counselor said.

America’s monetary policy has been at the center of the blame game over the huge amounts of investment that has trickled out of emerging markets, and for the severe currency losses in Brazil, Indonesia, Turkey, India, South Africa, and Russia.

Tapering has had a positive effect on the dollar, which has gained against emerging economies. India’s rupee has had one of its worst years ever, and in 2013 lost 11 percent against the dollar. More recently, Russia’s ruble has hit a 5-year low against the dollar, reaching 35 rubles per dollar early Wednesday afternoon. Earlier in the weak, when the ruble hit a 5-year low against the euro, the Russian Central Bank Chairwoman explained the ruble wasn’t weakening, but the dollar and euro were becoming stronger:

“As a general rule, the stronger the economy, the stronger the national currency. It’s not the ruble that weakened, but it’s the euro and the US dollar that have appreciated against all emerging market currencies,” bank chair Elvira Nabiullina said Monday during an interview with Russia’s First Chanel.