Janet Yellen to become the first female US Fed boss

US Federal Reserve vice chair Janet Yellen has been picked by President Barack Obama to take over as head of America’s central bank at what is widely considered to be a crucial period for the country’s economy and banking industry.

The 67-year-old New Yorker will become the first woman to lead

the national bank and also the first Democrat to head the Fed,

since 1979, when President Jimmy Carter nominated Paul Volcker.

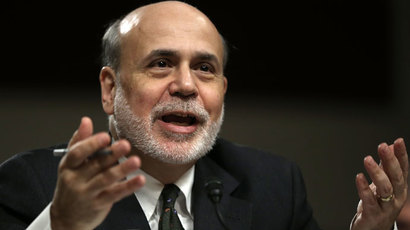

On Wednesday, President Obama formally nominated Janet Yellen, whom he called "one of the nation's foremost economists and policy makers." Yellen will chair the Federal Reserve board, replacing Ben Bernanke after his second four-year term comes to an end at the beginning of next year.

"American workers and families will have a champion in Janet Yellen," President Obama said. "She's tough, and not just because she's from Brooklyn."

President Obama took the stage with Yellen and current Fed Reserve chairman Ben Bernanke. He has been commended for his handling of the bank’s strategy during the recession of the late 2000’s, the country’s worst since the Great Depression of the 1930’s.

Bernanke, whose eight-year term will expire on January 31, is also credited with introducing a wide range of quantitative easing programs that helped pull the United States out of the gutter during that difficult time. Among them are, lending money to banks when the markets froze, reducing the short-term interest rate to almost zero, and buying trillions of dollars in bonds with the aim of reducing long-term borrowing rates.

Yellen was his loyal ally in the quantitative easing program, which has caused a rift between the Federal Reserve board and those voicing concern over the massive bond buying.

Her ascendency was a surprise, given that Lawrence Summers was thought to be Obama’s long time favorite, before the former Treasury secretary abandoned the race last month in the light of strong opposition, primarily from Montana Senator Jon Toester, whose refusal to support Summers’ candidacy at the Senate Banking Committee is thought to be one of the motives behind his withdrawal. Furthermore, Bernanke is a Republican, but the committee favors Democrats with a three-vote majority. Their decision not to support Summers is considered to be another strong reason.

"I have reluctantly concluded that any possible confirmation process for me would be acrimonious and would not serve the interest of the Federal Reserve, the Administration or, ultimately, the interests of the nation's ongoing economic recovery," Summers told President Obama in a letter, as cited by the Wall Street Journal on September 15.

In some sense, Yellen’s candidature is more favored by Wall Street’s critics than Summers’. Firstly, her 20-year track record with the Fed was evaluated by the Center for Public Integrity, who concluded that she “now appears determined to ensure that banks fortify themselves against financial shocks and that regulators have the power to police the system.”

And secondly, Summers’ advocating of financial deregulation during the Bill Clinton era had landed him in bad water with analysts, since it is those policies that eventually led to the financial crisis.

Yellen also came out on top after the WSJ examined upwards of 700 economic predictions coming from 14 Federal policymakers over the 2009-2012 period.

But most importantly, she is credited with giving the earliest warning of an impending crisis – all the way back in 2005.

Although Bernanke became forever associated with the beneficial quantitative easing policies associated with battling the crisis, it is Yellen, his loyal ally, who is seen by some as the architect behind getting the federal government to stimulate the economy.

Although 45 percent of Federal Reserve employees are women, the Obama administration has had to endure criticism that very few of them are in senior positions. Yellen’s ascendency should go some way to rectifying that, some analysts believe.

The change in chairmen comes at a very sensitive time in the history of the US banking industry. At this moment $85 billion is being fed into the economy as part of the quantitative easing policies started in Bernanke’s time.

Presently the Congress is also debating raising the US debt ceiling. It was Bernanke who first argued that failure to do so would have an adverse effect on the country’s economic recovery.