The end of Easy Street? Fed debates loose-money policies

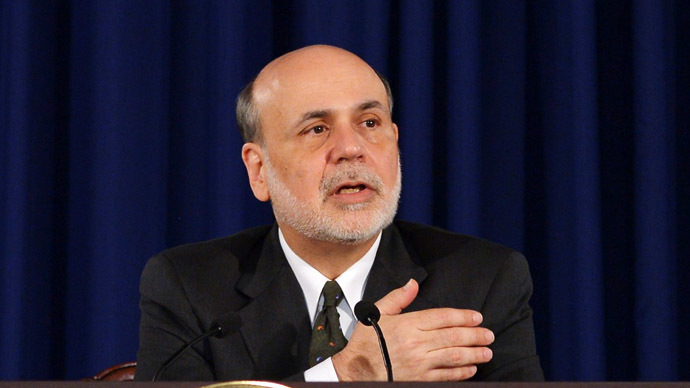

Federal Reserve Chairman Ben Bernanke was greeted with a divergence of opinion as the central bank considers putting the brakes on its $85 billion-a-month bond-buying program later this year.

"You can only conclude that highly accommodative monetary

policy for the foreseeable future is what's needed in the U.S.

economy," Bernanke said on Wednesday at a conference held by

the National Bureau of Economic Research.

The Fed chief said he anticipates the central bank won't raise

short-term interest rates until the US unemployment rate drops to

6.5 percent, which would be more than a percentage point lower

than its current 7.6 level.

Bernanke’s remarks on Wednesday followed the release of minutes

from last month’s Federal Open Market Committee policy meeting,

which showed uncertainty among officials over when to start

winding down the bond-buying program.

"Some participants had become more confident of sustained

improvement in the outlook for the labor market and so thought

that a downward adjustment in asset purchases had or would likely

soon become appropriate," the minutes showed. At the same

time, others "were concerned that stating an intention to slow

the pace of asset purchases…might be misinterpreted as signaling

an end to the addition of policy accommodation or even be seen as

the initial step toward exit from the (Federal Reserve's) highly

accommodative policy stance."

The Fed, which controls US monetary policy, pointed to high

unemployment, low inflation and a "quite restrictive" fiscal

policy as reasons for going ahead with quantitative easing. The

Fed's bold bond-buying program is intended to strengthen the

economy by keeping down long-term interest rates and driving up

the value of other assets, like stocks and property.

Fed officials emphasized that their decision on bond purchases is

separate from any decision on raising short-term rates, which

have remained near zero since the start of the financial crisis

in late 2008. "Many members indicated that decisions about the

pace and composition of asset purchases were distinct from

decisions about the appropriate level of the federal funds

rate," excerpts from the minutes said.

If the US economy continued to meet the Fed's expectations, bond

purchases would decline with the possibility that the program

could come to an end by mid-2014, Bernanke said after the June

conference. He also suggested the Fed could continue the program

if inflation, now near 1 percent, fails to meet the Fed's 2

percent objective.

The news seemed to have little impact on investors, many of whom

seem confident that the Fed will not resort to measures that will

inflict damage on the market. The Dow Jones Industrial Average

ended the day down 8.68 points, or 0.1 percent, at 15291.66. US

bond prices dropped, with the yield on the benchmark 10-year

Treasury rising to 2.688 percent.

How will the possible reduction of monetary stimulus by the

Federal Reserve affect the business climate in Russia?

Anna Bodrova, Investcafe analyst, thinks that the winding down of QE3 marks a good time for long-term investments.

"We should realize that the fact that QE3 is coming to an end means that the US system is stable," Bodrova told RT. "Essentially, this is a good sign which tells investors that the period when the economy needed support is over and the system can now operate without such props."

Such a scenario would mark a good time for "buying long term."

Bodrova spelled out the most effective way of reducing the

stimulus.

"The best time to do this would be the middle of Q4 2013, and the optimum reduction, based on the monthly stimulation volume, would be $20-30 billion. If QE3 reduction happens at this time and to this extent, capital markets will respond with a quick yet short-term drop, and then there will be a stable upswing," she advised.

"But if the reduction happens earlier, say, in September, when the US economy has not yet sufficiently demonstrated its stability, capital markets can take the June slump even deeper, and the Russian market may be selling more than other."

Not all analysts are so sure that the rollback of the US monetary

stimulus will be an altogether positive scenario for Russia's

business climate

Yaroslav Lissovolik, chief economist at Deutshche Bank, believes the effect of the rollback will generally be negative due to Russia being ranked as a "risk asset."

“The tapering of stimulus will lead to less liquidity and will effect Russia through commodity channels,” Lissovolik told RT. With the monetary reduction, there will be “less liquidity for risk assets,” of which Russia is considered to be a part of.

At the same time, the economist said a move away from economic stimulus will work to drive down oil prices, due primarily to the lack of demand.

While all 19 Federal Reserve board members and regional Fed presidents participate in discussions, only 12 have the authority to vote on policy.

The minutes do not identify speakers in the meetings by name.