Nord Stream will cost Gazprom more to export gas

Gazprom`s plans to transfer gas shipments from Ukraine to the Nord Stream pipeline are turning out unexpectedly expensive.

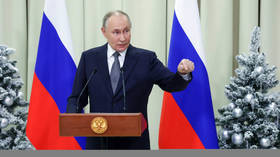

The price of moving gas through both Ukraine and Nord Stream significantly increased by 20 % in just first six months of 2012, Kommersant daily reports. At the same time the volume of Russian gas going through Ukraine decreased by 15% by the end of last year. Once the second stretch of the Nord Stream was opened at the end of last year it reached its full capacity of 55 billion cubic meters per year. However, the head of East European Gas Analysis Michael Korchemkyn says the pipeline is currently only using about one-third of its capacity. He believes switching gas export away from Ukraine to Nord Stream will mean not only higher delivery costs but also other expenses, Kommersant daily reports. Many transit contracts with European countries have ship-or-pay condition and lower volumes mean fines for Gazprom. There is another challenge for Russia`s gas monopoly– the company`s sales are predicted to fall in 2013 due to weak gas demand in Europe, which is still struggling to overcome the consequences of the global economic recession. Gazprom`s European partners, including French GDF Suez, Austrian Econgas and German Wingas and WIEH, have asked to review gas prices for 2013. In 2012 Gazprom decreased its prices by around 10% for some of its major European partners as well as to Slovenia’s SPP and Turkey’s Botas. While Gazprom is experiencing difficulties and has posted its worst results in a decade, its closest European rival Norway is moving to overtake its primary position. Norway reported record high exports last year, around 107.6bn cubic meters, getting very close to the level of Russian gas exports to Europe. The Scandinavian rival has what Gazprom can’t afford – lower prices. Competitive pricing in times of weak economic conditions and the EU`s desire to diversify away from Russian gas supplies represent now the main challenges faced by the Russian gas supplier.The EU has accused Gazprom over alleged unfair competition and price fixing in the natural gas markets of Central and Eastern Europe. In September the European Commission launched an anti-trust probe against Russia’s gas major Gazprom. If Gazprom is found to have broken the rules it could be fined 10% its annual revenue or $1.1-1.4bn. Gazprom hasn’t admitted any wrongdoing, but decided to divide its European assets to meet the requirements of EU’s "third energy package" and avoid anti-trust claims. Russian President Vladimir Putin has signed a decree that prohibits companies deemed strategic, with Gazprom among them, from disclosing information, disposing of assets or amending agreements without ratification by the Russian authorities in the case that the claims are initiated by foreign states or companies.