Strategic failure: Iceland allowed 2008 bank collapses to support households

Iceland is the land of active volcanoes and unexpected decisions. During the crisis in 2008 the government let its banks collapse instead of bailing them out, as they proved too big to save. The next challenge is to bring unemployment rate to 2 percent.

Iceland, whose stock market after the 2008 financial crisis

plunged 90 percent while unemployment rose ninefold, has chosen a

risky crisis-management policy as a way-out. After shrinking by

over 10 percent during 2009-2010, Iceland's GDP began to recover.

During the worst financial crisis in six decades, successive

Icelandic governments forced banks to write off mortgage debts to

help households, and while the euro area struggles with record

unemployment rate (with over 25 percent in Greece and Spain),

Iceland has a reason to celebrate, with joblessness in December

as low as 4.5 percent, according to Statistics Iceland. The

number of persons in the labor force in the fourth quarter last

year was 184,600, which corresponds to an activity rate of 80.7

percent.

The prime minister recently announced that the next big challenge

for the small island nation with the population of 325,620 is to

see unemployment going to under 2 percent, because, as Sigmundur

D. Gunnlaugsson told Bloomberg in January, "Icelanders aren’t

accustomed to unemployment.”

At 85 percent, Iceland's labor-market is the highest in Europe

and one of the highest in the world. In December alone, 172 new

private limited companies were registered in the island, compared

with 147 in December 2012. The largest number of new

registrations was in financial and insurance activities. In 2013,

1,938 new private limited companies were registered, which is a

10.6 percent increase compared with 2012.

On January 24, Standard & Poor's Ratings Services revised the

outlook on Iceland to stable from negative. S&P estimated

that Iceland's proposed mortgage debt relief program will have a

cumulative fiscal cost of about 6 percent of GDP over the next

four years. It is expected that the government will finance the

program through increased taxation and not higher deficits. High

external debt burdens remain key ratings constraints, however.

"Although Iceland's economy was able to adjust after the

crisis through currency depreciation and private sector defaults,

a nonresident holding of ISK-denominated assets presented a large

overhang to the currency markets. The Central Bank of Iceland

addressed this through foreign exchange controls implemented in

2008. Its plans to lift the controls have been hampered by the

country's shallow domestic capital markets and the significant

risks of capital flight," S&P said in a statement,

adding that the need for continued foreign exchange controls is a

credit weakness for the sovereign ratings on Iceland.

Iceland’s inflation has mostly come via the exchange rate

protected by capital controls. Over the past 12 months, the krona

has appreciated about 10 percent against the euro.

"Although we’re spending more on welfare matters today than

before, we have to keep in mind that purchasing power has gone

down since 2008," a sociology professor at the University of

Iceland, Stefan Olafsson, told Bloomberg.

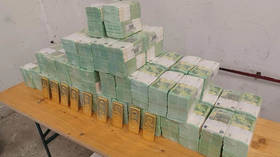

Despite overwhelming criticism from international financial

institutions, Iceland’s government (formed after the April 2013

election) announced in November that it will be writing off up to

24,000 euro ($32,600) of every household’s mortgage, fulfilling

its election promise. The government said the debt relief will be

spread out over four years and will begin by mid-2014; and the

prime minister has promised that public finances will not be put

at risk.

According to estimates, the measure is set to cost $1.2 billion

in total, reduced by 13 percent on average. The design of the

measures could result in foreign creditors of the defaulted

Icelandic banks bearing around three quarters of the cost of the

household debt forgiveness, however. The International Monetary

Fund (IMF) said Iceland has "little fiscal space for

additional household debt relief," while the Organization

for Economic Cooperation and Development (OECD) stated that the

island should limit its mortgage relief to low-income households.

Iceland's financial sector has been restructured since the bank

defaults of 2008. In what became the biggest penalty for a

financial scandal in Iceland's history, four former bosses from

the failed Kaupthing Bank were sentenced to between three and

five years in prison in December, and must pay millions of pounds

in legal costs. They were convicted of fraud ahead of the

collapse of the country's biggest bank in October 2008. The

bankers were accused of concealing an investor from Qatar, which

bought a 5.1 percent equity stake in Kaupthing, with the money

illegally provided as a loan from the bank itself.

In 2008, Kaupthing and other Icelandic banks, such as Landsbanki

and Glitnir, were on the brink of collapse and had borrowed funds

on the money markets to provide credit to customers. The amount

borrowed was more than six times Iceland's gross domestic

product. Kaupthing collapsed in 2008 under the weight of huge

debts.