Ex-JPMorgan traders charged in $6.2bn ‘London Whale’ case

Former JPMorgan Chase traders Javier Martin-Artajo and Julien Grout were charged by US federal prosecutors for manipulating bank records and understating losses in the $6.2 billion ‘London Whale’ financial debacle of 2012.

In a blow to Wall Street and America’s largest bank by assets, prosecutors filed charges against Martin-Artajo, 49, a former London-based managing director and trading supervisor, and Grout, 35, an ex-trader at the London office.

The two charged men, whose arrest warrants were issued

August 9, haven't been located by authorities. Grout, a French

national, is reportedly in France, and Martin-Artajo is

reportedly on a planned holiday, according to statements from

their respective lawfirms.

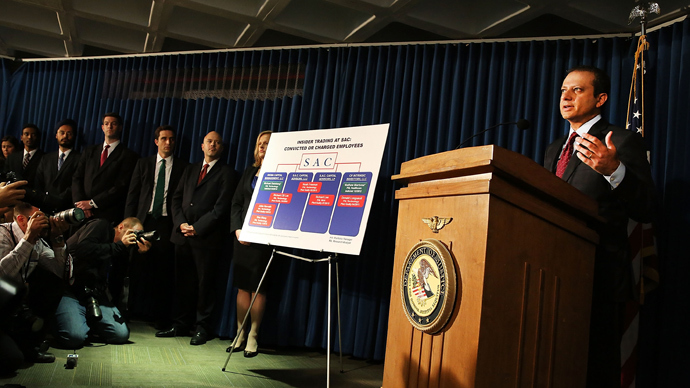

“The defendants' alleged lies misled investors, regulators and

the public, and they constituted federal crimes,” said

Manhattan US Attorney Preet Bharara at a press conference.

Bharara said, in response to CEO Jamie Dimon’s previous comments,

"this was not a tempest in a teapot, but rather a perfect

storm of individual misconduct and inadequate internal

controls."

The pair “knowingly or recklessly, employed devices, schemes

and artifices to defraud and/or engaged in acts, practices and

courses of business,” the complaint said.

The two were charged with conspiracy, falsifying books and

records, wire fraud, and registering false filings with the

Securities and Exchange Commission (SEC). The SEC is pursuing a

separate civil complaint, which will likely result in a hefty

fine for the bank, with the employees to be barred from working

in the financial industry.

Bosses off the hook

Prosecutors announced they will not charge Bruno Iksil, largely

known as a “London Whale” for the extent he cooked the banks'

books. According to Bharara, he “sounded the alarm more than

once”, and as long as he fully cooperates with the FBI and

the Manhattan US Attorney’s Office, will face no charges.

JPMorgan CEO Jamie Dimon, CIO Ina Drew, and Achilles Macris, who

ran the London trading office, and everybody who were part of the

‘London Whale’ have so far not been legally pursued.

False earnings

Due to the improper conduct by these traders, the bank falsely

reported quarterly earnings with the FEC on April 13, 2012, as

they were “based in part on false and fraudulent information”

from the “London Whale” books from March to May 2012. A third,

still anonymous co-conspirator also will be investigated on this

charge.

The bank was forced to restate its first quarter earnings, which

they re-evaluated and slashed by $459 million, after taking into

account the fraudulent derivatives losses.

British authorities are conducting their own separate inquiry

into the bank's derivative loss cover up.

The bank’s ex-employees allegedly covered up losses when they

initially told regulators losses amounted to £8million, when in

reality the sum was closer to £4bn. The scandal later became

known as the ‘London Whale’, coined after the location and the

magnitude of the losses.

The world’s biggest lenders paid over $20 billion to regulators

and individuals in 2012 to compensate for breaking rules and finance

manipulation during the financial crisis.