$750 billion question: Norway voters decide future fate of massive oil fund

The new center-right government, expected to assume power in Norway after Monday’s election, will be faced with a high-profile dilemma other European countries can only dream of. Namely, what to do with $750 billion dollars?

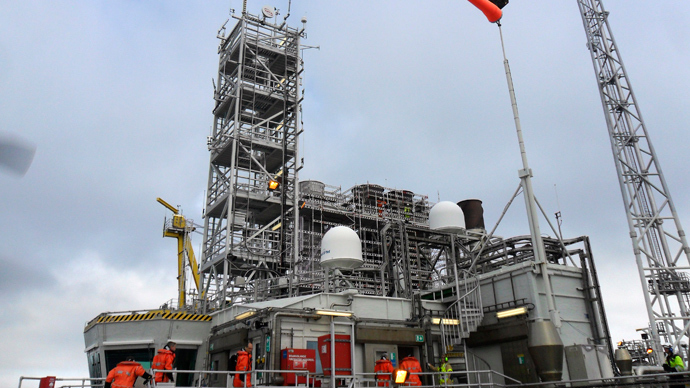

Established in 1990 as a repository for the country’s oil profits, the Government Pension Fund has become the biggest sovereign investment body in the world, after quadrupling in value since 2005. If divided up between the country’s 4.9 million people, it would leave each Norwegian with $145,000 in cash.

In placid Norway – where economic growth is expected to round out at three percent, while the rest of Europe’s economies shrink – the fate of the windfall has dominated the campaign, feeding on an anxiety that comes with having more money than the country obviously needs, and a fear of not capitalizing on a historic opportunity.

Current rules allow the government to use no more than 4 percent of the fund to finance the budget, but the center-left coalition, in power for eight years, has been more cautious still, using only 3.3 percent or $21 billion to cover this year’s budget deficit.

It claimed that as the real value of the fund increases, the actual figure should be even lower, or Norway will risk making its manufacturers uncompetitive. Norwegian industrial wages are already 70 percent above the European average.

But the Conservatives say the problem is that the money has been invested in bloating the welfare state as opposed to infrastructure, education and tax cuts, which would pay for themselves in the medium term.

The populist anti-immigration Progress Party, which is likely to form the ruling coalition with the Conservatives, has gone further and wants to scrap the 4 percent spending limit altogether.

“What we’ve been spending the money on is having fun today, we have not been spending for the next generation. If you can invest it in the current economy, that’s also going to be good for the economy,” Ketil Solvik Olsen, finance spokesman for the Progress Party said in a recent interview.

But Conservative leader Erna Solberg has said that "We will not be part of a government that carries out an irresponsible economic policy.”

The party does want to make the fund’s investments more profitable. One mooted solution has been the division of the single fund into several competing entities, a model that has been used in neighboring Sweden. The fund, which on average owns 1.25 percent of every listed company in the world, has already become more active in recent months, inserting its members on executive boards, as opposed to watching from afar.

“It’s all about one thing: increasing the return on our investments without taking more risks,” said Solberg.

The traditionally cautious investment vehicle has about 60

percent in stocks, 35 percent in bonds and since 2010 has been

able to invest up to 5 percent in real estate.

Its biggest individual holdings are Nestle, Royal Dutch Shell and Apple, though it does not allow itself to own more than 10 percent of any one company.

Some Conservatives have proposed that plowing money into large infrastructure projects would be another way to diversify the holdings, although the center-left government insists that the fund should take “small steps”, and gain more experience with real estate before jumping into another arena entirely.

In any case, government officials estimate that the fund will

grow by a further 50 percent by the end of the decade.