US and UK rich enjoy lowest tax rate

While the US administration presses for the 'Buffet rule' to ensure rich people pay at least a 30% tax, thousands of American millionaires don’t pay any federal income tax.

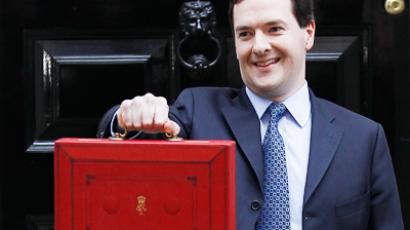

As many as 7000 millionaires are among those who would pay no individual income tax at all in 2011, according to research from the Tax Policy Center of the Urban Institute and the Brookings Institution. While in 2009 about 1470 million-plus-earners saw their income tax cut to zero, according to IRS data.Also some top earners pay a lower effective tax of rate than some middle class taxpayers, as they receive a big share of their income through capital gains, not with a paycheck.However, the top 20% earners paid 70% of federal taxes in 2007, while the poorest 20% only pay 2.1% of total taxes, according to the most recent data from the Congressional Budget Office.But there are not only US millionaires who pay lower taxes. Almost 10% of Britons earning more than £10 million a year pays less than the 20% basic rate of income tax, while less than three quarters pay more than 40% income tax, the UK Treasury revealed.The UK government plans to cut the top rate of income tax to 45% from 50% on incomes over £150,000 in order to decrease tax evasion. The move was considered pro-rich and caused outrage among middle class Britons.Tax Policy Center has also reported that about 46% of taxpayers in the US won’t pay any federal income tax for 2011. As much as 23% of them have a low income and take their personal exemption, while another 23% qualify for tax breaks or get a refund. At the end of the 1960s only about 12% of Americans didn’t pay federal income tax, according to Heritage Foundation study.Also about 21.8 % of U.S. citizens or 67.3million people receive financial assistance from the federal government, not including government employees. It means that the number of people paying taxes is declining, while the number of citizens dependent on government money is on the rise.The relieving fact is that the most US tax payers can’t avoid numerous local and federal taxes such as excise taxes on things such as gas, cigarettes, alcohol and airline tickets as well as taxes on clothing, groceries, etc.