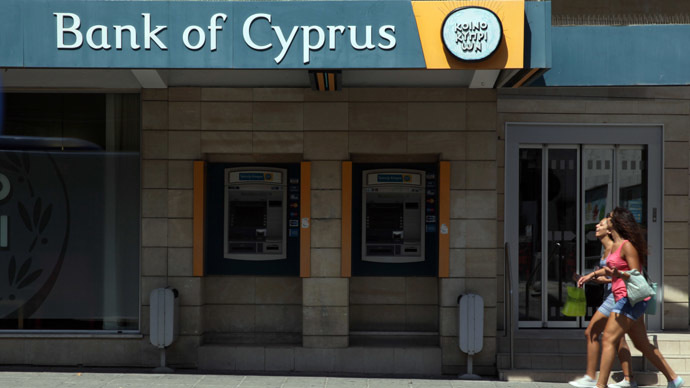

Moscow makeover: Bank of Cyprus elects 6 Russians to board

Six Russians were elected to the 16-member board of directors of the Bank of Cyprus. The substantial minority demonstrates the large stake Russia had, and will continue to have, in the Cypriot banking system.

Vladimir Strzhalkovskiy, a former KGB official and Putin ally,

was elected by other board members as vice chairman.

Strzhalkovskiy is also the former CEO of Russia’s Norilsk Nikel,

the world’s largest nickel and palladium producer.

Other approved nominees are Dmitry Chichikashvili, president of Insigma Group, a Moscow-based construction company, Igor Lazhevsk, Deutche Bank’s deputy chairman for Eastern Europe, Anzhelika Anshakova, a board of director of Binbank, Eriskhan Kurazov, General Director at CJSC, a Moscow-based finance group, and Anton Smetanin.

Vladimir Sidorov, the former deputy head of investment at

Vneshekonombank, was short-listed, but not elected. Sidorov also

runs MCRS Ltd, a lift service in Cyprus.

All Russian board members were nominated by law firms with close

ties to Russian and Chinese investors.

The other approved board members are Christis Hassapis, who will

serve as the chairman, Costas Hadjipapas, Marios Kalochoritis,

Konstantinos Katsaros, Erishkan Kurazov, Adonis Papaconstantinou,

Xanthos Vrachas, Marinos Yialelis, Marios Yiannas, Andreas

Yiasemides, and Ioannis Zographakis. None of the nominees

were from Western Europe or America.

49 names were submitted for consideration, most of which

represented individual or corporate interest.

Interim CEO Christo Sorotos was not appointed to continue his

leadership role in the bank’s restructuring.

Nominees were mostly major depositors, both domestic and foreign, who held, and lost, billions of dollars when their wealth was used to bail out and save the Cyrpriot banks in March in an unprecedented ‘bail-in’.

A general shareholder meeting was held in Nicosia on Tuesday with

53 percent of share capital present (both in person and by

proxy), representing about 2.5 billion shares.

Protestors outside of the bank before the general meeting

demanded greater transparency, as shares plummeted from nearly 1

euro to 1 cent during the bank’s financial restructuring. The

bank absorbed the assets of Laiki Bank which was forced to shut

down in March.

“We want transparency . . . We want to know on what basis the

value of our shares has shrunk by 99 per cent,” Stavros

Agrotis, a Nicosia stockbroker, said. Some shareholders left the

meeting in protest.

President Putin decided against using government funds to bailout

Cyprus, but agreed to restructure a 2.5 billion loan issued in 2011.

Cyprus instead turned to the ‘Troika’ of lenders - which agreed

to fund $13 billion (€10 billion) of the island’s bailout package

on the condition an internal ‘hair-cut’ was applied- a levy of

47.5 percent on all accounts with over €100,000 in

deposits.

The corporate tax rate in Cyprus is 10 percent, half of Russia’s,

which made it a useful tax haven for Russian money. Up to

$30 billion was deposited in the island’s

banks.

The strategy to keep funds in Cyprus turned into a billion dollar

headache when funds were levied and converted into bank equity,

which turned Russian depositors into big shareholders overnight.