First Swiss bank agrees to ‘sellout’ its US clients

The Swiss regional lender Valiant Bank has agreed to a US voluntary disclosure programme aimed at divulging information on American tax evaders.

"The costs of the US program will not jeopardize the financial stability of Valiant in any way. This decision does not endanger the distribution of an unchanged dividend," Reuters quoted Valiant as saying in a statement published late on Monday.

According to an internal review, the bank had never had a lot of US clients, with Americans being 0.1 percent of its client base, Valiant said.

Swiss financial regulator FINMA is expecting a number of banks to agree to the US clearance examination on any past transgressions, and face fines which can be up to 50 per cent of the assets depending on how flagrantly the banks acted in their dealings with American customers.

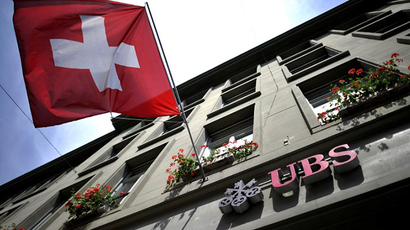

The US authorities have been chasing Swiss lenders since they forced UBS, the country’s biggest bank, to pay $780 million for its role in contributing to tax evasion in 2009.

The other banks which came under suspicion are EFG International, St. Gallen Kantonalbank, which owns private bank Hyposwiss, Linth Bank and Banque Cantonale Vaudoise.

These banks will likely be the first to cooperate with US authorities; however Switzerland still has hundreds of other banks on the US list.

If banks refuse to provide information to US authorities, individual firms and senior staff may run the risk of criminal prosecution. A dozen of Swiss banks such as Credit Suisse, Julius Baer, Pictet, and local government-backed Zuercher Kantonalbank are already under US Department of Justice’s formal investigation and may refuse to cooperate.