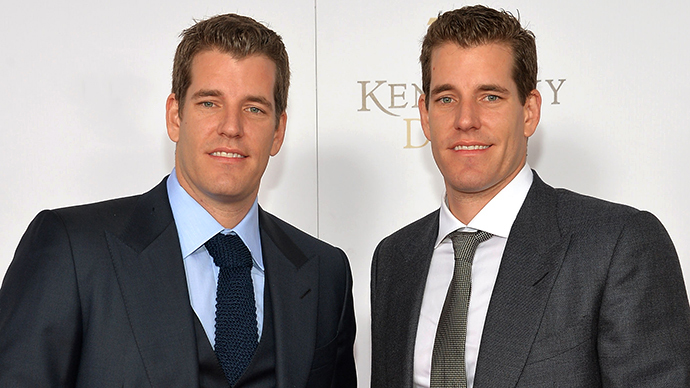

Winklevoss twins file for $20 million Bitcoin IPO

Tyler and Cameron Winklevoss, the key backers of Bitcoin, have filed with the US Securities and Exchange Commission (SEC) to set up an exchange – traded fund for the virtual currency to popularize it, and allow it to be traded like stocks or commodities.

The game plan by the twins best known for suing Facebook CEO Mark Zuckerberg involves an exchange – traded fund that would hold only Bitcoins. Such a fund will significantly simplify access to Bitcoins – the way commodity – based funds made investment in precious metals easier.

The Winklevoss Bitcoin trust wants to sell a million of Bitcoin shares, where each is valued at 0.20 Bitcoins.

“The trust brings Bitcoin to main street and mainstream investors to Bitcoin. It eliminates the friction of buying and reduces the risks associated with storing Bitcoin while offering similar investment attributes to direct ownership,” as bitcoin.com quoted Tyler Winklevoss as explaining the motivation behind going public.

In the filing with the SEC the Winklevoss twins said that shares in the trust are “designed for investors seeking a cost-effective and convenient means to gain exposure to Bitcoins with minimal credit risk”.

At the moment the filing is incomplete, as it doesn’t stipulate

neither the IPO date nor the exchange where the trust wants to be

listed.

Bitcoin has been around since 2009, but got a push in 2011, when its value grew to $2 per coin. Though Bitcoin can be exchanged for other currencies and used to pay for goods or services, it doesn’t exist in a physical form. A network of users create Bitcoins, or “mine” them, by means of complex algorithms on a computer. One can buy the currency on exchanges and through services like BitInstant and Coinbase. The maximum number of Bitcoins that can be created is limited to 21 million, while currently the number of coins stands at about 11 million. The value of Bitcoins is determined by the value that various market participants place on Bitcoins through their transactions. Such companies as Western Union, MoneyGram and eBay’s Paypal have recently become interested in Bitcoins, saying they were assessing using the currency on their platforms.

The move comes at a time when digital money is facing a barrage of regulatory questions and enforcement action. At the end of May US authorities stopped operations in another virtual currency – Liberty Reserve -, having charged the system with a “$6 billion money laundering scheme and operating an unlicensed money transmitting business”.

Since the payment systems using virtual currencies are entirely regulated by its users, with governments having no control over either the currencies supply nor transactions, they’ve been blamed for enabling “a broad range of online criminal activity, including credit card fraud, identity theft, investment fraud, computer hacking, child pornography, and narcotics trafficking”.

The scrutiny of virtual currencies involved the Tokyo-based Mt.Gox exchange – the largest place to buy and sell Bitcoins. Before the exchange registered with the US Treasury Department as a money services business complying with money laundering laws, some of its accounts across the country were frozen. Mt. Gox temporarily stopped its clients from cashing out their Bitcoin operations, saying an unusually high demand for Bitcoin operations made it difficult to perform timely and efficiently.

All the attacks on virtual currencies show a significant level of risks for the owners of Bitcoin shares. The SEC filing has a separate 18 page section enumerating “risk factors.” Key are the heavy presence of speculators and “an uncertain regulatory landscape”.