Latest US sanctions will hit EU – energy expert

Newly imposed US sanctions against Russia’s Gazprombank are expected to send energy costs surging in parts of Europe, Finam Financial Group analyst Aleksandr Potavin told TASS on Friday. The risk of secondary restrictions will force buyers of Russian oil and gas to seek new payment tools, he predicted.

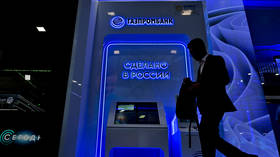

On Thursday, the US Treasury Department introduced blocking sanctions against more than 50 Russian lenders, including Gazprombank and six of its international subsidiaries. The new penalties effectively cut one of Russia’s largest banks off from the SWIFT interbank messaging system, meaning it can no longer carry out dollar-based transactions. Gazprombank’s assets in the US have also been frozen.

“Due to the new sanctions against Gazprombank, foreign buyers of Russian gas and oil will be faced with the need to look for alternative payment routes that are likely to complicate the entire process, increase risks, and make the payment procedure more expensive,” Potavin said.

He specified that European buyers could use accounts in other banks or pay for energy supplies via other world currencies as an alternative.

“The new sanctions will lead to an increase in prices for Russian hydrocarbons in Europe, and supply disruptions can’t be ruled out as well, since all this creates new risks for foreign companies working with Russia,” he explained.

According to Alexander Frolov, expert at the InfoTek energy news center, the latest restrictions won’t have a direct impact on buyers of Russian gas who previously agreed to adopt the “gas for rubles” scheme to pay for their energy purchases. They will only apply to individuals and legal entities subject to US jurisdiction, he said, as quoted by TASS.

The analyst admitted, however, that companies using rubles for Russian energy supplies are at risk of secondary sanctions, “so gas buyers from Europe will turn to the US Treasury for clarification.”

Supplies of Russian pipeline gas to Europe have substantially declined due to Ukraine-related restrictions and the sabotage of the Nord Stream pipelines, although EU nations are still importing record volumes of LNG from the sanctions-hit state. Despite the bloc’s vows to drop purchases of Russian energy, it remains one of the world’s major buyers of Russian fossil fuels. In August, pipeline gas comprised the largest share of the EU’s purchases of Russia’s fossil fuels (54%), followed by LNG (25%), according to the Centre for Research on Energy and Clean Air (CREA).