Austerity medicine fails to cure Greek financial ills

The Greek debt crisis has taken a sharp turn for the worse, as the country’s government admits it will not meet key EU-mandated deficit deadlines for 2011 and 2012. The news sent Asian markets plummeting on Monday.

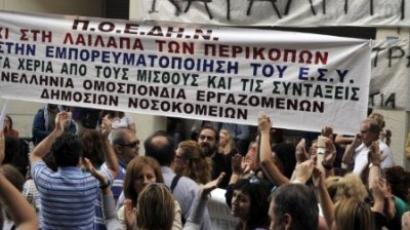

Draft budget figures released by the Greek government Sunday indicate that despite taking harsh austerity measures to avert bankruptcy, the country will miss a deficit target.The 2012 draft budget approved by the Cabinet on Sunday predicts a deficit of 8.5 per cent of GDP for 2011, missing the 7.6 per cent deficit target, Reuters reported.The Finance Ministry announced Sunday that the missed target was due to a deeper-than-expected recession, with the economy contracting by 5.5 per cent instead of the 3.8 per cent estimate made in May. It implied the deficit could even exceed this level by the end of the year unless all new austerity measures were implemented."Three critical months remain to finish 2011, and the final estimate of 8.5 per cent of GDP deficit can be achieved if the state mechanism and citizens respond accordingly," the Finance Ministry said in a statement.The Cabinet met Sunday night to approve the 2012 budget and complete a plan to cut civil service staff by 30,000 by the end of the year. Initially, the civil servants will placed in reserve and their wages will be reduced. The final decision on dismissal will be taken in winter.The unfavorable announcement by the Greek government comes as Troika, consisting of the International Monetary Fund, EU and European Central Bank representatives, is inspecting Greece’s books in weighing whether to release the next tranche of the bailout. Greece requires at least eight billion euros of fresh loan injections to avoid bancruptcy. Without yet another bailout, Greece is expected to run out of cash by the end of October.Meanwhile, Asian markets tumbled on Monday as investors digested the news, AFP reports. Fears over a sovereign default by Greece and its potential impact on the world economy saw Japanese stocks fall by 2.34 per cent, despite an improvement in the Bank of Japan's survey of business confidence.