Cypriot parliament approves part of 'Plan B' for bailout as deadline looms

In a bid to secure an EU bailout, the Cypriot parliament has adopted laws creating a “solidarity fund” to pool assets as the basis for an emergency bond issue and allowing the government to impose capital controls for the country's banks.

Also on Friday the parliament adopted legislation allowing the

government to split the island's failing lenders into "good" and

"bad" banks, Reuters reports. The new law will be used to

restructure Cyprus’s second-largest lender, Laiki Bank.

The measures are part of the ‘plan B’ package of measures intended to secure a bailout package from the international lenders, as the island nation verges on bankruptcy.

Capital controls on Cypriot banks were imposed as a measure to prevent runs on them.

No agreement on deposit levy

Lawmakers have yet to decide on whether to impose the controversial levy on bank deposits that sparked massive public discontent and fears among foreign investors, most of them Russians. The parliament rejected the levy proposal on Tuesday.

And according to reports, the Cypriot government will debate the levy on bank deposits only after the finance ministers of the 17-nation eurozone meet on Sunday, Reuters quoted a senior lawmaker as saying.

The most likely scenario is a tax of 20-25 per cent on deposits of more than 100,000 euro [US$130,000] at the Bank of Cyprus, AFP reported.

Cypriot President Nicos Anastasiades and party leaders are due to arrive in Brussels on Saturday for talks with EU officials to discuss measures to avoid bankruptcy.

Debate continues

The nine bills presented include plans to recapitalize its vastly oversized banking sector - with assets about eight times the size of the actual economy - and lay losses on big depositors.

As politicians inched closer towards an agreement, hundreds

of demonstrators faced off with riot police outside parliament late

into Friday night.

The adoption of new measures comes amid strong pressure from the EU, Germany and leading bankers for speedier actions. On Monday Cyprus will need to reach a deal with the eurozone and the International Monetary Fund before the ECB carries out its threat to withdraw liquidity support.

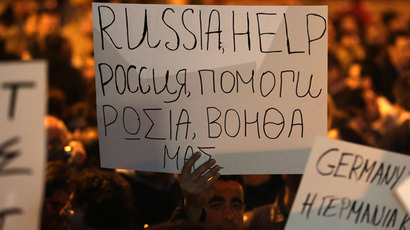

Cyprus hoped to get help from Russia. However, the two-day negotiations between Cyprus's finance minister and his Russian counterpart failed to provide anything tangible. Michalis Sarris left Moscow empty-handed on Friday after Russia said it would not help out Cyprus before it agrees a bailout deal with the EU.

Though Russia has not withdrawn from efforts to settle Cyprus' problems, said Prime Minister Dmitry Medvedev on Friday.

Tesa Arcilla, RT’s correspondent in Nicosia, the Cypriot capital, explained that there is a widespread feeling of negativity, especially at the EU, the Troika and Germany.

“It’s not fair, this situation is not just for economic reasons, the main reason is the Europeans want to send the Russians out of Cyprus ,” a Cypriot man told RT.

People are worried that the European Central Bank will only supply liquidity to the country until Monday and after that only if an EU, IMF program has been agreed.