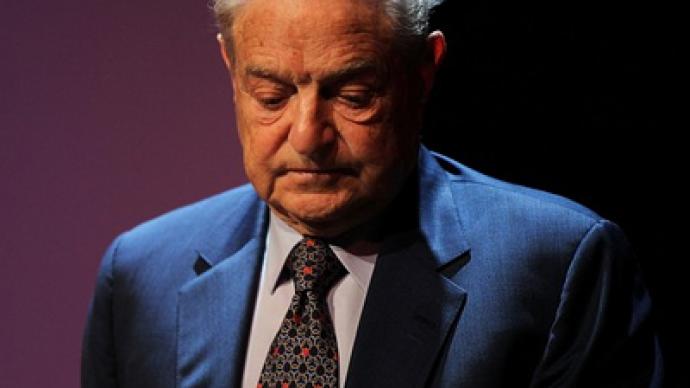

A new global economic policy is on the table at a meeting in the American town of Bretton Woods. Economists, finance experts and scholars from across the world are gathered at the conference, held by billionaire George Soros.

The chosen venue has great historic significance – this was the setting of the famous Bretton Woods Conference of 1944, which set the monetary system for the world as we now know it.This is where the International Monetary Fund and what is now the World Bank were established, with the US dollar becoming the reserve currency for the world at this same conference.Back in 1944 it was the United Nations that got together the allied countries towards the end of World War II. However, today it is a very different story.This time it is billionaire George Soros bringing together two hundred intellectuals, with the belief that the current economic thinking and the current world monetary policy systems are no longer working.Since the financial collapse shook the globe and reverberated all across the world, there hasn’t been anything to replace the old system, something which might reflect the new world, where the US is not the one singular power that dictates economic policy.The idea among the thinkers in Bretton Woods is that there needs to be a system which reflects the fact that we live in a multi-polar world, a system which brings developing nations into the conversation. Many of those nations with booming economies have become rivals to developed nations such as the United States.“So, you come to 2010, and for the first time virtually for nearly 200 years America and Europe – that’s the United States of America and the 27 members of the European Union, for the first time are being outproduced, outmanufactured and outexported, and also, interestingly, outinvested by the rest of the world,” former British Prime Minister Gordon Brown told the conference.One of the key problems economists are now facing is the necessity to develop new, more efficient, ways of dealing with enormous financial deficits, particularly America’s skyrocketing debt. The United States is paving the way with more than one trillion dollars of deficit each fiscal year, adding up to more than 14 trillion dollars in debt – a problem which the US political leadership does seem to be eager to deal with.

Dollar diminishing in significance – Soros's think-tank

Robert Johnson, the executive director of the Institute for New Economic Thinking, George Soros' think-tank, which is leading the conference, in his opening speech questioned the effectiveness of current financial governance and called for measures to restore trust in the system.“At this time, I do not think people are trusting governments after financial bailouts. I do not think they trust experts by and large… That’s the nature of the problem, that’s why INET was formed,” he told RT.However, Johnson says it is not so easy to come up with a recipe to regain the trust of people who feel betrayed by the billion-dollar bailouts around the world.“I’m particularly concerned about the United States, which is at the center of the world system. The middle class in the United States is feeling compressed. They are experiencing what you might call a social death, while two to three per cent are doing very, very well,” he continued. “Almost all of the gains from 1979 to the present, perhaps more than 100 per cent, have gone to the top one per cent, and that’s just not sustainable, and that is not inspiring of trust.”Commenting on the current situation with the dollar as the world's reserve currency, Johnson said that the prevailing view among delegates at the conference is that the dollar is diminishing in significance for various reasons:“The dollar is diminishing in significance, somewhat for natural reasons, because the United States is the smaller proportion of the world economy, as the emerging countries, like Russia, Brazil, India and China, grow,” he said.At the same time, Johnson continued, the dollar may be suffering from the fact that leaders in the United States have not paid enough attention to strengthening the underlying economic conditions, such as infrastructure, education, scientific research and maintenance of demand.“If you have a damaged and diminished population, damaged infrastructure and… paltry or non-existent investment, you are not going to have a strong economy, and the dollar will be a reflection of that,” Robert Johnson concluded.

Gerald Epstein, Professor and Chair of Economics at the University of Massachussetts at Amherst, says emerging countries and financial regulators have much heavier responsibilities in the face of the global financial crisis.“We need global cooperation to get us out of that current crisis, but also to help us to make a transition to a new type of economy where power is more widely dispersed around the world,” he said, “an economy that can deal with climate change and make the green transition that we need.”

Roman Frydman, a professor of economics at New York University, noted that the BRICS countries are accounting for an increasingly larger part of world consumption.“US consumption, by some estimates, is expected to go down to as little as 20 percent,” he said. “And Europe will be another 20 percent. And the rest of the world will be about 60 percent. That’s a major, major transformation. And all these countries will play a much bigger role… in the next couple decades.”