Germany’s central bank is set to reclaim some of its vast gold reserves held in the US and France. The move follows an audit criticizing Bundesbank for mismanagement, stating the funds had never been “verified physically.”

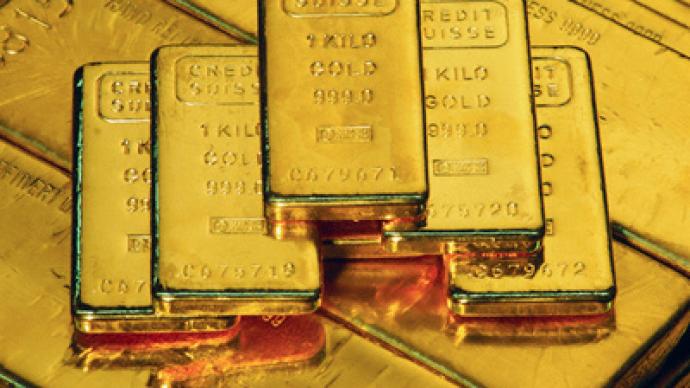

Bundesbank announced plans to withdraw its entire 374-ton store of gold bullion from the Bank of France in Paris, and 300 tons of the 1,500 tons currently held by the New York Federal Reserve.The German government refrained from commenting on the reports ahead of its presentation of a new plan for the management of its gold reserves on Wednesday. Germany boasts the world’s second-largest bullion reserves at 270,000 gold bars ($177.5 billion), second only to the US.Germany’s gold stockpile was relocated abroad during the Cold War amid fears of a possible Soviet invasion. There is no reason now to maintain overseas stockpiles, Bundesbank said – from now on, the bank will only keep small amounts of gold abroad for trading purposes.About 30 percent of Germany’s gold reserves are currently being held in the country at the facilities of Frankfurt-based Bundesbank."Now, the political security situation has changed because the East-West conflict is over. Considerations to store the gold as far west and as far from the Iron Curtain as possible had to be reconsidered," Bundesbank board member Carl-Ludwig Thiele told reporters on Wednesday. He added that gold was an important resource “to create confidence in the currency and in the economic power of our country."The move follows a damning report by the German Court of Auditors criticizing the management of Bundesbank’s foreign bullion stockpiles. Auditors said that the stores “had never been verified physically,” and were not under proper control. Bundesbank was taken aback by the criticism, stressing there was no need for speculation on Germany’s overseas holdings and that "there is no doubt about the integrity of the foreign storage sites." The central bank is widely regarded as one of the most trustworthy institutions in German society.Veteran gold dealer Jim Sinclair said that Bundesbank’s strategy marked a change in trends in the global gold market, heralding a move away from paper administration of funds."This sends a message about storing gold near you and taking delivery no matter who is holding it,” Sinclair told British newspaper the Telegraph. “When France did these years ago it sent panic amongst the US financial leadership. History will look back on this salvo as being the beginning of the end of the US dollar as the reserve currency of choice.”