Usury illusion: UK borrowers turn to payday loans despite govt crackdown

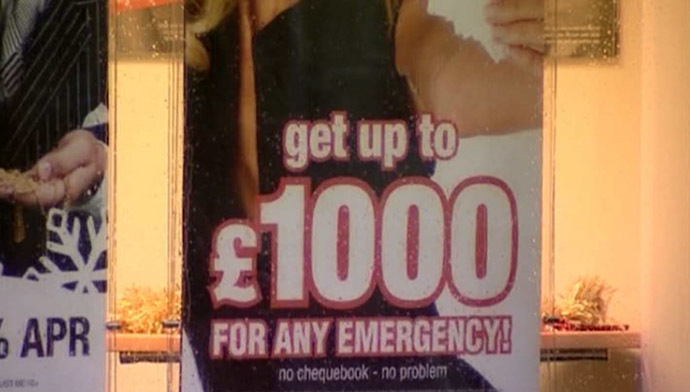

Eleven more British payday lenders have agreed to stop offering short-term loans as the government cracks down on firms charging onerous interest rates. However, many people still turn to lenders out of desperation.

Last year, stretched budgets meant that Britons took out 2 billion pounds worth of short-term loans.

It is a burgeoning industry, but it has taken hold quickly leaving government regulation to catch up.

There are remarkably few laws that govern how payday lenders operate.

Customers who have been refused credit by banks, who have exhausted every other means of securing a loan can simply apply online – and most are approved within moments. That means that consumers get their hands on the cash within minutes; the only problem is paying it back.

Louisa and her husband were bankrupt when she took out her first payday loan. She couldn’t afford to pay it back.

“Sometimes they would call up and say ‘do you want to sell your jewelry, do you want to take out another payday loan to pay that one and have even more money? And they still call us now,” she told RT’s Polly Boiko.

Louisa’s two loans of 250 pounds each ended up costing over 2,000 pounds. The financial pressure meant that her two sons had to relocate to live with their birth father.

“Once things started going wrong, it just seemed to continue forever and it is still like that now, even though it has been eight months after we’ve paid them off. And we’re still having it tough,” Louisa said.

Payday lenders can charge any rate of interest they like - often up to 5,000 percent. The industry has been accused of bullying borrowers into taking out multiple loans, lending money to drunk individuals, people with mental health issues, and even to children.

The Office of Fair Trading has told the UK’s 50 biggest lenders, to stop handing out loans irresponsibly. So far, 28 have replied to the ultimatum with 22 firms yet having to come up with a response.

“We saw a couple last year, who between them had racked up 36 payday loans, due to a combination of reduced income and financial shocks. The UK government needs to come forward with a rigorous plan in order to better protect vulnerable consumers from payday loans,” says Joseph Surtees from StepChange Debt Charity.

Wonga is the UK’s largest payday loans company. Its new head of Public Affairs used to be an advisor to David Cameron, leading to accusations that the government is lobbying its interests with government. Wonga reportedly paid for meetings with Conservative ministers.

“They paid in excess of 1,000 GBP to have a 15-minute talk

with someone from government. That's not right; you're using your

influence because you have money and because they want money for

their election,” noted John Robertson, a Labour Party MP.

“These companies don’t give out money for nothing. They are wanting something in return and the kind of return they’re wanting is for people to back off, and to be fair to the Tory government they have backed off quite well so far.”

Councils up and down the country have blocked access to payday loan websites from computers in libraries and public buildings to stop constituents being tempted by instant cash that will plunge them into debt.

However, many struggling Britons, despite being warned, are still finding all that instant cash far too tempting.