Spanish banks finance production of Gaddafi’s bombs

As more NATO bombs rain down on Libya, it has come to light that companies from one NATO member state have been supplying banned bombs to Muammar Gaddafi. Several large Spanish banks have reportedly been financing the manufacture of cluster bombs.

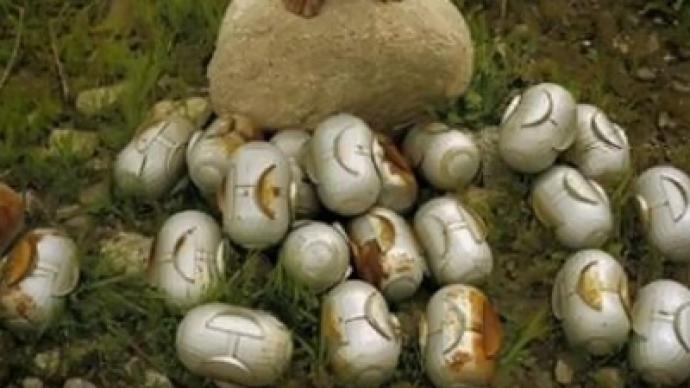

In just one strike, each cluster bomb can spread up to 2,000 smaller explosives, called “bomblets”, over a wide area. Fired into populated areas, they almost guarantee civilian deaths. This is why 57 countries have banned their use, stockpiling, production and transfer, ratifying the Convention on Cluster Munitions (CCM), which is a binding international law. A total of 109 states have signed the Convention.As such devices often fail to explode on impact, children sometimes mistake the unexploded bomblets for something to play with.According to the Human Rights Watch organization, the markings on shells found in the Libyan city of Misrata belonged to Spanish company Instalaza SA. “There were arms, MAT-120s, that are prohibited, that were purchased by Gaddafi and used against the residential area in Misrata, and they were produced by a Spanish company and financed by Spanish banks,” claimed Annie Yumi Joh, an anti-war campaigner from Madrid.In 2007, when the Tripoli regime fell back into favor with the West and decades-old international military sanctions against Libya were lifted, Instalaza won a contract to supply Gaddafi's forces with the MAT-120 weapon and did so until 2008, when Spain signed-up to the CCM. But with Libya now once again the enemy, Spain as part of NATO finds itself fighting a regime the country itself helped to arm.But the trail goes back further, to Spanish banks, which provided the financial firepower to Instalaza to make their deadly weapons of war. It turns out there is a loophole in the CCM banning the production and use of the cluster bombs – but not banning investment into their production.“There is one article in the Cluster Munitions Convention, article 1C that speaks of a prohibition to assist, and a lot of countries have already interpreted this article as also containing investment. Spain has not yet done so,” said Esther Vandenbourcke, author of the report "Worldwide Investments in Cluster Munitions: a Shared Responsibility".It means that while Instalaza can no longer produce and sell cluster munitions, Spanish banks can continue to invest in their manufacture.Spanish NGO SETEM's investigations have uncovered that Spain alone had 14 banks involved in financing 19 makers of cluster bombs.BBVA is the Spanish bank that has been most active in funding producers of controversial weapons. And it is exactly this large-scale funding that has pushed campaigners to call for more robust policies that ensure the banks are held accountable.“Banks are not that transparent about what they are using the savers' money for, and it’s not that easy to find out,” added Esther Vandenbourcke.Many of the banks named in the investigation are now coming forward to say their policies on funding arms production are going to change.However, until that happens, in the murky world of arms production, war remains a profitable business.