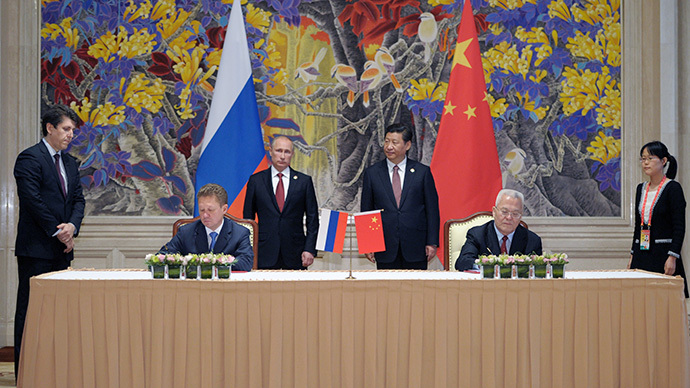

Eastern energy pivot threatens the US dollar

The “Power of Siberia” is much more than a 30 year Sino-Russian gas/pipeline deal. Paying for the process accelerates the vogue to reduce dollar pricing. That, not the energy supply, will become the most acute threat to US economic hegemony.

The superlatives have flowed as effortlessly as one day the gas will. At a stroke Russia has hugely diversified its energy sales with a $400 billion pivot. A fascinating by-product of the energy factor is the money element. The singular superpower era has been fuelled by an American economy benefitting from “dollarization”. Global reserve currency status has hugely fuelled America’s ongoing experiment in "government by irrational exuberance." Washington has grown addicted to borrowing cheaply, exploiting its reserve currency to spend liberally on all vestiges of government. Thus the powerhouse private economy of the United States runs parallel to a massively inefficient government spending machine. Being a reserve currency has multiple benefits - other nations habitually trade in dollars thanks to global benchmarks. Hence, oil, gas and indeed illicit narcotics are all traditionally priced in the dear old greenback. Surplus dollars often find their way back to the USA and end up holding US Treasury Bonds - the debt which feeds big government.

Recent moves to break dollar hegemony in energy pricing have been led by various Gulf states. Now, China and Russia have a perfect opportunity to circumvent dollars entirely with their bilateral deals creating a $77 billion pipeline (the world’s largest construction project) as well as the $400 billion gas transfer agreement. Thus the “Power of Siberia” is not merely an apt name for the pipeline stretching from Eastern Siberia to China’s populous north-eastern regions; it is also a maxim for the rise of alternative currencies.

While the US dollar epitaph has been written many times, it still isn’t imminent. However, a dollar centric era is clearly coming to an end. Despite the ongoing failure of the political euro to be recognised as a valid reserve currency, US dollar threats are emerging rapidly - free floating bitcoin, rubles and yuan can all become significant competitors to the greenback.

Even reduced reserve status has major implications for the USA. The more central banks, corporations, and indeed savers, prefer other currencies, the more difficult it is for the US to seamlessly borrow to feed its inherent overspending. Here the US is an agent in its own demise. Tax laws like FATCA and a misguided neocon ‘sanctionmania’ are driving alternative stores of value, even before we factor in the destructive impact on savers of the Fed’s quantitative easing.

QE is akin to another reserve currency trait, known in the economics fraternity as “exorbitant privilege.” For the US to pay bills, it can just print more cash and satisfy any debt denominated in dollars. The increasingly integrated global economy has enabled Washington to abuse exorbitant privilege at a scale unknown to previous reserve currency nations such as Imperial Britain.

While the US dollar has been the established pricing unit for global energy, the petrocurrency play has helped maintain US reserve currency hegemony. However, America has overplayed its cards, borrowing too heavily, ignoring fiscal discipline and then endeavouring to bully the rest of the world to maintain its erratic standards. Ironically even the ‘good news’ of US shale further weakens the dollar’s reserve status. With less import demand from an increasingly self-sufficient US, why will exporters want to price in US dollars? After all, the world’s biggest oil importer China already has grave misgivings about the US dollars it holds. Indeed its existing energy deals with Brazil bypass the dollar.

The Eastern trade pivot will take a remarkable edge off America’s

ability to simply kick the can down the road fiscally. Meanwhile

the US government needs to borrow (conservatively) $2.7 billion

per day. “The Power of Siberia” will likely be financed

in construction and operation through expansion of the existing

Sino-Russian swap facilities established between Beijing and

Moscow i.e. without recourse to US dollars. Thus removing the

dollar from the energy price is becoming more feasible by the

day. Any expansion may not be very apparent by 2018 when the

pipeline is due to open. Nevertheless ongoing US dollar hegemony

is being endangered by each and every eastern trade deal.

In Washington DC, the pork barrel politicians of “Kickcanistan” must adjust their

thinking, and particularly their spending, to take account of the

eastern pivot.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.